Finances and Money

When it comes to finances: There’s never been a better time to get creative with your side hustle! You might be surprised by the many different ways you can make money on-the fly.

Maybe that old car of yours is just sitting around getting rusty and dusty, but it could really help out someone else in need if they have the cash?

Think outside (of) the box too; cleaning up homes after parties or doing yard work will also bring in extra income (especially during these warm summer months).

Why not make a little money and get rid of some stuff at the same time? There’s no reason why you can’t find someone who needs what you’re Selling. Sell your Lawn Chairs, Clothes or whatever else comes to mind!

I’m sure there are plenty out their willing (and ready)to buy it from you so break those creative caps now– Craigslist, Ebay and Amazon is another option too…personals ads offer interesting opportunities if done correctly.

Here are a few suggestions for you to consider.

1. Yard Sale

If you find yourself short on money and need to make some right away, there’s always yard sales.

Clean out your home and put all the things in front of it that don’t belong for sale – this includes anything from clothes to furniture (and even cars).

You’ll probably get more than what people are offering since most folks like buying used products over-new ones; but if not just take their offer anyways because we know how hard these days can be!

Remember too strike while the iron is hot. Make the sale and move on.

2. eBay

One way to make some extra money is by selling items on eBay. You can list things in your home that you don’t need or want, like clothing and artwork for example – but there’s also the option of purchasing low-priced goods from stores which are then listed on eBays so people know they’re available at bargain prices if needed!

One popular type of listing through third party sites such as Etsy may be figurines (children’s toys), household items etc. And if one doesn’t want these products anymore? List them online too because someone might just buy them up quickly enough before anyone else does

3. Second Job

If you need the guarantee of money each week you’ll want to consider a second job. This will give you the feeling of security because you know you’ll have money coming in. You won’t have to worry about selling items and stressing over nobody buying from you.

There are a number of places you could work at that would work around the hours you put in at your other job. Maybe evenings or weekends only or whatever you need. Fast food, department stores, and clothing stores are just a few for you to consider.

4. Direct Sales

Direct sales companies are another way to supplement your income. You don’t have to worry about making the product or handling the money when you work with a company and sale their products for them.

You can work with companies like Avon or Beauty Society to name a few. All you have to do is market their products and sign people up and they’ll handle the rest for you. You’ll make money each time they order and that’s sure to help supplement your income.

When the money you make isn’t enough to cover your expenses you need to think about supplementing your income. These are a few of the many options you need to consider.

It’s important to find a way to make the money you need and still be able to handle everything going on each day. While it may not be the easiest thing to do, when you’re in a situation where you need the money, you have to do what you have to do and these options will help you make it through the difficult time.

Personal Finance QuickStart Guide: The Simplified Beginner’s Guide to Eliminating Financial Stress

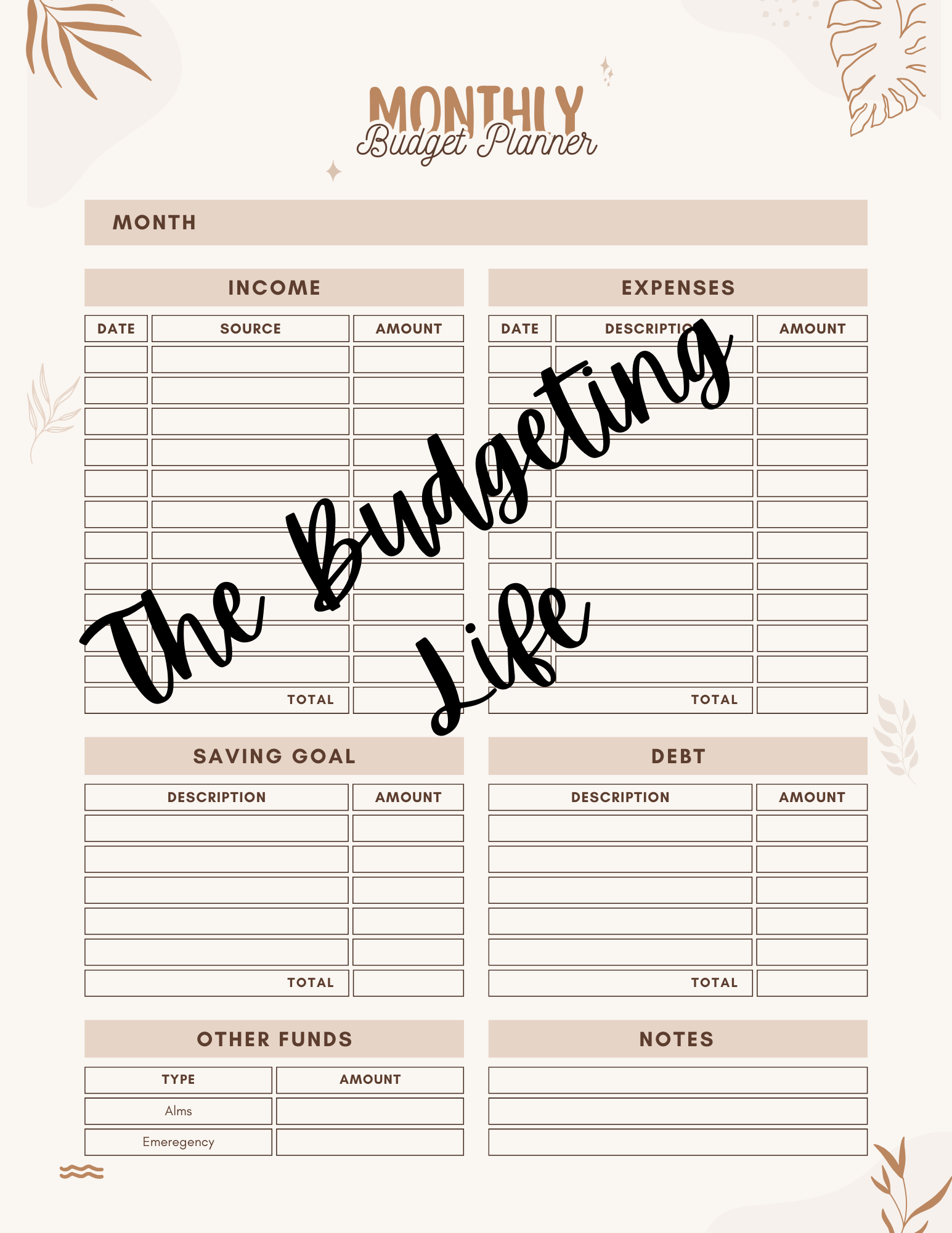

Tracking Finances and Expenses

Keeping track of your finances and expenses will help you when it comes to paying bills, saving money, and having the ability to do extra things.

If you don’t know where your money is going you may not be able to do what you need with your money. When you keep track of your income and expenses you’ll have the ability to make changes so you can purchase something you may not otherwise be able to do.

If you have no idea where your money is going you won’t be able to control things, eliminate things, and you won’t be able to do the extra things you desire. Vacations won’t happen and you’ll struggle and stress if your vehicle breaks down or your basement floods.

If you’ve tried to manage your budget in your head you may have found it didn’t work too well. That’s because you can’t remember how you spent every penny and more than likely you can’t remember how much every bill is you owe.

With our very busy lives, it’s nearly impossible to remember everything, so it’s not worth it to mess something up by trying to remember everything.

There are two techniques you can consider when you’re trying to track your income and expenses.

1. Pencil and Paper

Using a pencil and paper is one way to track everything. You’ll have access to it whenever and you won’t have to worry about losing it if the power goes out or your computer were to crash. It’ll be easy to make changes as well.

You can use regular paper or you can purchase paper specifically designed for keeping track of your income and expenses. They also have paper books that are for this task as well.

2. Computer Program

Using a computer program is very efficient and worth the time it takes to add the income and expenses to the program. It may take time to create and work each time, but it will be worth it when you avoid mistakes.

You’ll have the ability to create charts to help you put your finances and expenses into categories which will help you know where you can make changes.

For example, if you spend a lot of money on eating out, you can put this in as a category and you’ll know how much you’re spending so you can make changes.

Try Google Sheets its free!

When you consider both of these options and you figure out which one will work for you you’ll see the stress go away and you won’t have to worry about your finances and expenses.

You’ll have them under control and you’ll know where every penny goes. You’ll have the ability to make changes when you need to and you’ll know at all times where your income and expenses sit.

This will help you control every aspect of your income and expenses without the stress of trying to remember it by heart. You’ll eliminate errors and you’ll find the changes you’ll be able to make will be priceless.

Leave a Reply