In today’s fast-paced and demanding world, trying to reduce debt and managing personal finances can be a challenging task.

Many individuals find themselves burdened by debt, struggling to make ends meet.

However, by implementing practical strategies to cut expenses and reduce debt, you can regain control of your financial situation and pave the way to a brighter future.

In this article, we will explore effective methods and actionable tips to help you trim your expenses, pay off debt, and achieve the ultimate goal of financial freedom.

Related: How to make a budget: Step by Step

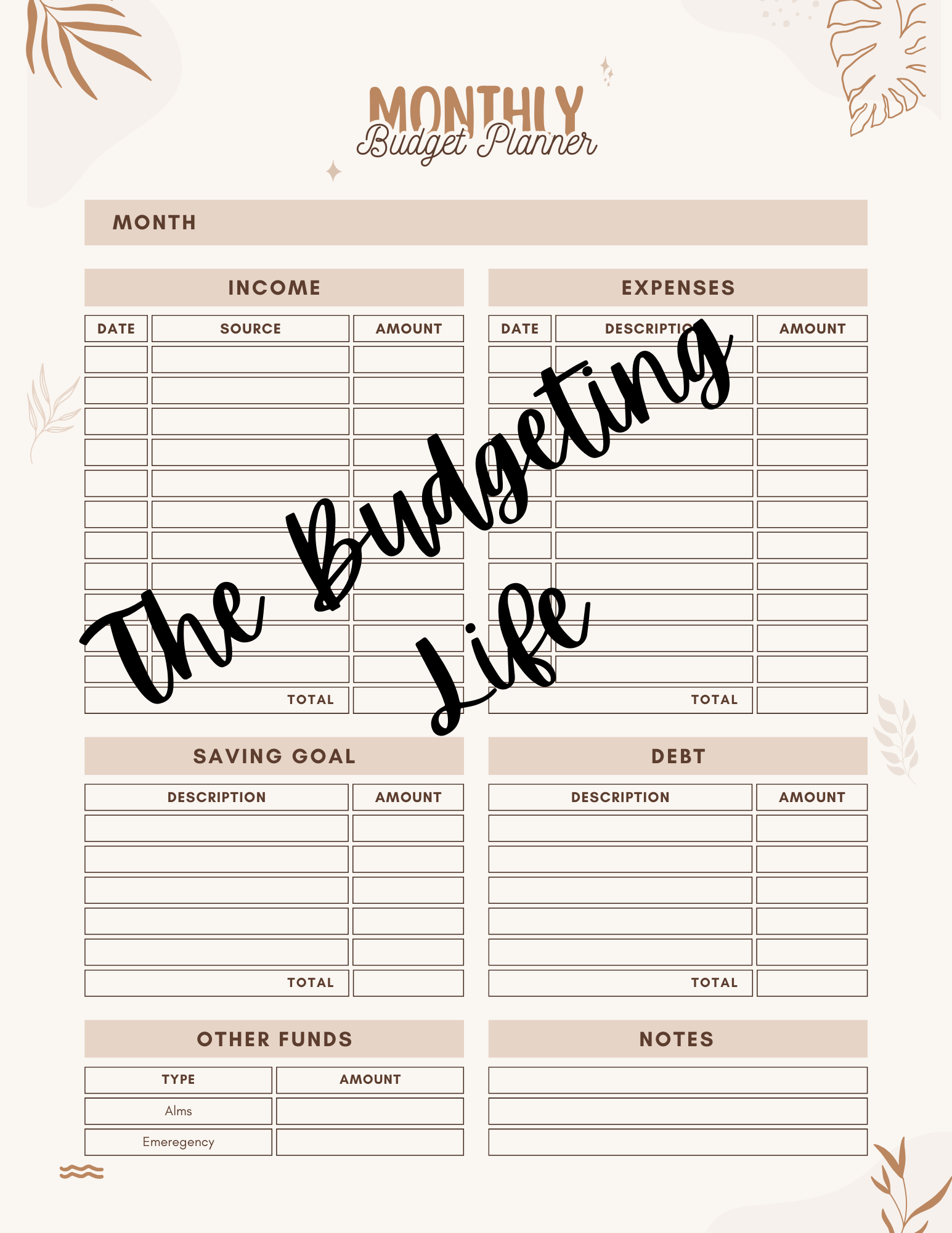

Financial Freedom: Create a Comprehensive Budget:

The foundation of any effective financial plan is a well-structured budget. Begin by analyzing your income and expenses to get a clear understanding of your financial inflows and outflows.

Categorize your expenses into essential and discretionary items. Identify areas where you can cut back and allocate more funds towards debt repayment.

By adhering to a budget and tracking your expenses diligently, you can identify areas of overspending and make necessary adjustments.

Trim Your Monthly Expenses:

Cutting back on your monthly expenses is a practical approach to free up more funds for debt repayment. Consider these cost-saving measures:

- Review your utility bills and seek opportunities to reduce energy consumption by implementing energy-efficient habits.

- Evaluate your subscription services and cancel those that are unnecessary or underutilized.

- Opt for generic brands instead of premium ones when shopping for groceries and other household items.

- Negotiate with service providers, such as internet and cable companies, to secure lower rates or switch to more affordable alternatives.

- Minimize dining out and start cooking meals at home. It not only saves money but also promotes healthier eating habits.

Pay Debt

Consolidate and Refinance To Reduce Debt:

Managing multiple debts with varying interest rates can be overwhelming. Consider consolidating your debts into a single loan with a lower interest rate.

Debt consolidation simplifies the repayment process and reduces the overall interest paid.

Alternatively, explore the option of refinancing high-interest loans, such as credit card debt, with a more favorable interest rate.

This can significantly lower your monthly payments and help you pay off your debt faster.

Prioritize And Reduce Debt Repayment:

To reduce debt effectively, prioritize your debts based on interest rates. While making minimum payments on all debts, allocate any additional available funds towards the debt with the highest interest rate.

This strategy, known as the debt avalanche method, saves you money in interest payments over time. As you pay off one debt, redirect the freed-up funds towards the next debt on your list until you achieve debt freedom.

Explore Additional Sources of Income:

Increasing your income can accelerate your debt repayment journey. Consider taking on a part-time job, freelancing, or monetizing a hobby or skill you possess. The gig economy offers numerous opportunities to generate extra income, allowing you to allocate more funds towards debt repayment.

Negotiate with Creditors To Reduce Debt:

If you find yourself struggling to make monthly debt payments, don’t hesitate to reach out to your creditors.

Explain your situation and propose a repayment plan that is more manageable for you.

Many creditors are willing to work with individuals who demonstrate a genuine commitment to repaying their debts.

Negotiating lower interest rates, extended payment terms, or even partial debt forgiveness can alleviate financial stress and expedite your path to becoming debt-free.

Related: 6 Reasons You Should Have an Investing Strategy

Seek Professional Guidance:

Reduce Debt=Financial Freedom

If your debt situation feels overwhelming or you need expert advice, consider seeking the help of a financial counselor or debt management agency.

These professionals can provide personalized guidance, assist in creating a debt repayment plan, and offer strategies to improve your financial health in the long run.

Conclusion:

Cutting expenses and reducing debt requires commitment, discipline, and a strategic approach.

By creating a budget, trimming monthly expenses, consolidating debt, prioritizing repayment, exploring additional income sources, negotiating with creditors, and seeking professional guidance, you can embark on a transformative journey towards financial freedom.

Remember, every step you take to cut expenses and reduce debt brings you closer to a life of financial security and peace of mind.

Start implementing these practical strategies today and pave the way for a brighter and debt-free future.

Leave a Reply