Budgeting For Specific Expenses

In today’s fast-paced world, financial planning and budgeting have become crucial skills for individuals seeking to achieve their goals and dreams.

While the concept of budgeting is familiar to many, specific expenses like buying a home, paying for a wedding, or planning a vacation often require more tailored financial strategies.

In this article, we will explore effective budgeting techniques to help you navigate these specific expenses successfully. By understanding the key principles of budgeting and implementing smart financial practices, you can take control of your finances and make your dreams a reality.

I. Understanding the Importance of Budgeting

Before diving into budgeting for specific expenses, it is essential to recognize the overarching significance of budgeting in general. Budgeting serves as a powerful tool for tracking income, managing expenses, and making informed financial decisions. It enables individuals to allocate their resources effectively and prioritize their financial goals. By creating a comprehensive budgeting plan, you gain clarity on your financial situation, identify areas for improvement, and ensure long-term financial stability.

Importance of budgeting

II. Budgeting for Buying a Home

- Assessing Your Financial Situation: Evaluating your current financial standing, including income, savings, and debt, is the first step when budgeting for a home purchase. This assessment will help you determine your affordability range, down payment options, and mortgage requirements.

- Saving for a Down Payment: Setting a realistic savings goal and establishing a dedicated savings account for your down payment is crucial. Implementing strategies like automatic transfers, cutting unnecessary expenses, and exploring down payment assistance programs can expedite your savings progress.

- Planning for Additional Costs: Beyond the down payment, it is important to account for other expenses such as closing costs, home inspections, moving costs, and potential renovations. Budgeting for these costs ensures you are prepared for the complete financial responsibility of homeownership.

Budgeting for a Wedding

III. Budgeting for a Wedding

- Defining Your Wedding Vision: Clearly outlining your wedding priorities and vision will guide your budgeting process. Determine the size, style, and location of your wedding, as these factors significantly impact your overall expenses.

- Creating a Realistic Wedding Budget: Assigning a specific budget to each wedding element, such as venue, catering, attire, and decorations, allows you to allocate funds wisely. Researching average costs, seeking multiple quotes, and prioritizing essential aspects will help you create a realistic and manageable budget.

- Managing Guest List and Invitations: Carefully curating your guest list can significantly impact your expenses. Keep in mind that each additional guest adds to your catering and venue costs. Utilize digital invitations or opt for cost-effective printing options to save on stationery expenses.

Budgeting for a Vacation

IV. Budgeting for a Vacation

- Setting Vacation Goals: Clearly define the purpose, duration, and desired experiences of your vacation. Whether it’s a relaxing beach getaway or an adventurous trip, understanding your goals helps in determining the budgetary requirements.

- Researching Destination Costs: Thoroughly research and estimate the expenses associated with your chosen destination, including accommodation, transportation, meals, activities, and travel insurance. Utilize online resources, compare prices, and consider off-peak travel periods for potential savings.

- Prioritizing and Saving: Analyze your monthly budget and identify areas where you can reduce discretionary spending to allocate more funds toward your vacation. Create a dedicated savings account, automate savings transfers, and explore cost-cutting strategies to accelerate your savings.

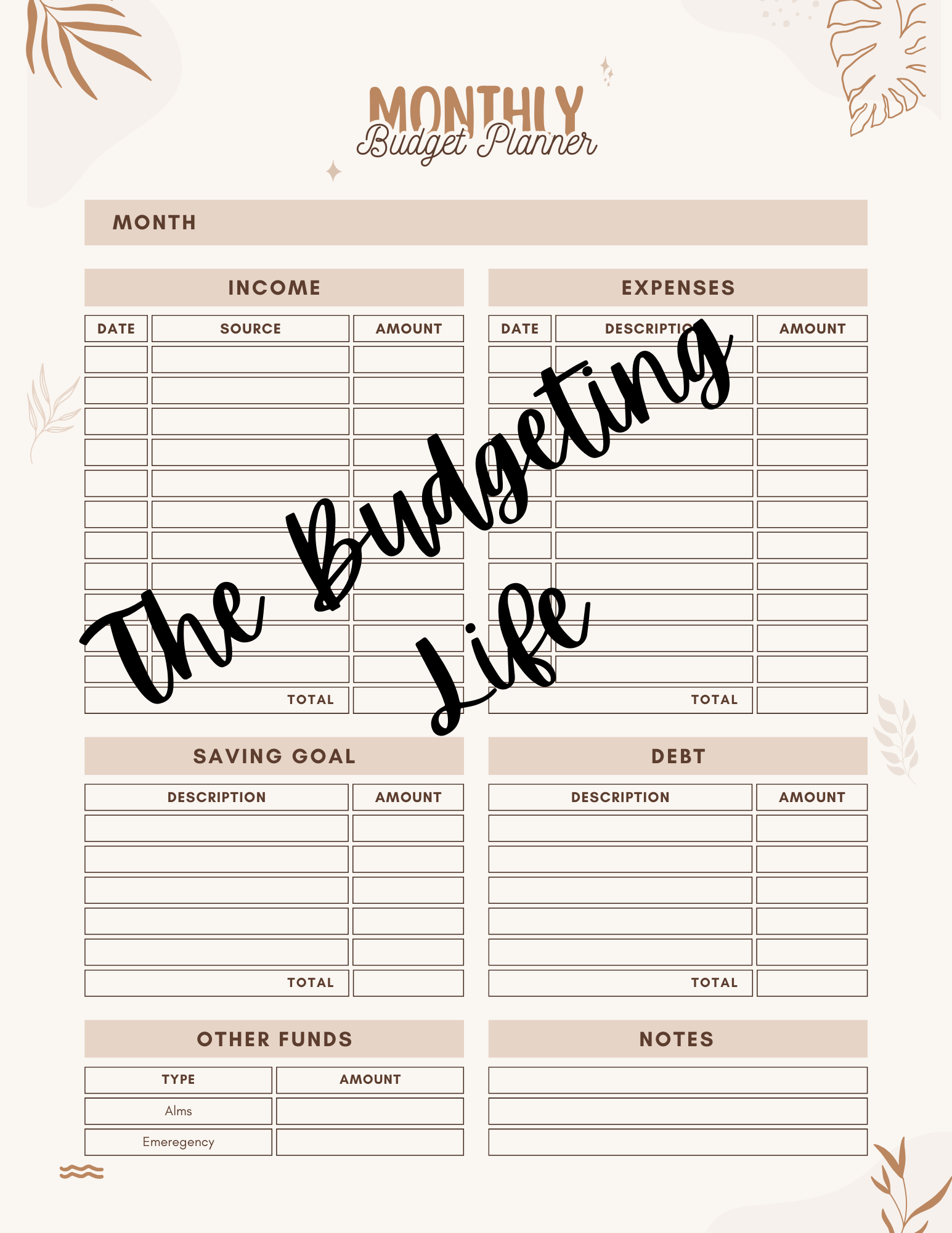

Get Started With This Budget Planner

Conclusion

Budgeting for specific expenses requires a combination of thoughtful planning, realistic expectations, and diligent execution.

By adopting the principles and techniques outlined in this article, you can approach significant expenses like buying a home, paying for a wedding, or planning a vacation with confidence. Remember, budgeting is a dynamic process, requiring periodic evaluation and adjustments as circumstances change.

As you embark on your financial journey, embrace the power of budgeting as a lifelong skill that empowers you to achieve your dreams while maintaining financial stability.

With dedication, discipline, and strategic planning, you can turn your aspirations into tangible realities and secure a brighter future.

Leave a Reply