How to budget and save money as a college student?

Posted in :

How to budget and save money as a college student?

The college years are all about learning and growing. One of the most important things to learn is ‘how to budget and save money as a college student’?

As a college student, you may not think that saving money is very important, but once you get out into the real world, it will be one of your top priorities because there won’t be mommy and daddy around to give you cash whenever you need it!

Here are some tips on how to budget and save money as a college student.

Tips:

How to Keep Away from Credit Card or Debit Card

It is because you will find yourself having more debts if you will make the most of your credit card.

One of the basic principles of managing money is to avoid spending cash more than what you can afford.

If you have some credit cards, this becomes easy to get into a huge amount of debt, which you will have a hard time to pay off.

There are some tips you may consider to keep away from credit card or debit card. One of these tips is to buy your needed items with your cash.

If you still have cash on your wallet or pocket, use it instead of your credit card. This will help you avoid using your credit card. But, this does not mean that you should not use credit cards. You can always use them, but do not abuse them.

Abusing credit cards or debit cards can be a total catastrophe particularly to those who always purchase things using these.

Another thing you may consider to avoid credit card is by avoiding places where you will be tempted to buy things that are needed for your studies.

When covering expenses for your studies, do not make use of credit cards or debit cards always. If you can pay it with cash or loan, then consider it as your option.

Though having a credit card can help you build your credit history in the future, but once you have failed to pay your debt, this may ruin your credit history and might hurt your credit score in the process.

Before applying for a credit card, knowing or understanding it is also important. This will help you consider avoid the things that you should or not do to get rid of any inconvenience.

Allocate Some Saving for Emergency Use

Saving money should not only be for your future expenses for your studies. You should also save money for emergency use.

This will help you avoid borrowing some money from your friends or parents. This also let you get rid of acquiring a loan that can add up to your debt in the long run.

So, allocate some saving for emergency use as this can make a difference.

Save Money: Emergency Fund

How to Allocate Some Saving for Your Emergency Use

Allocating some saving for your emergency use may not be an easy thing to do. But, there are ways you may consider. These are as follows:

Separate Your Savings for Emergency Use

If you find it hard to save for your emergency use, you may consider separating your savings. You should separate some of your money for your other purpose and for your emergency use. This will help you avoid using the money for some things that are not useful.

Deposit It Into Your Bank Account

If you are always tempted to spend your saving on various things, deposit it into your bank account. Once you have deposited it to your bank account, don’t check it regularly because this will give you temptations to spend it just to purchase things, which can be an extra expense on your budget.

Therefore, if you don’t want to spend saving for emergency use for things that are not useful and required, then deposit it immediately into your bank account.

Through considering those mentioned above, saving money can be done easily. So, if you want to have money that you can use for emergency purposes without relying on some people, then keep in mind those above-mentioned.

Benefits of Allocating Some Saving for Emergency Use

Emergency cash is an investment in your future. It can save you from endless debt and help to avoid tough times with loans, which could pile up debts even higher than they are now.

Emergency funds will also shield borrowers against predatory practices of lenders who want nothing more but for this money to go into their pockets as fast possible – don’t let them take advantage!

You’ll never regret having some emergency wealth at hand because it gives peace-of mind knowing that if all else fails there’s always enough waiting patiently until things get back on track again so we’re not left broke.

If you have this money, all you have to do is to withdraw it or get it in your own safe.

Although allocating some saving for emergency use is not a requirement for all students, this can help anyone minimize their expenses or debts as they will be using their savings instead of their present budget, which can be costly.

Track Your Spending on a Diary/Spreadsheet

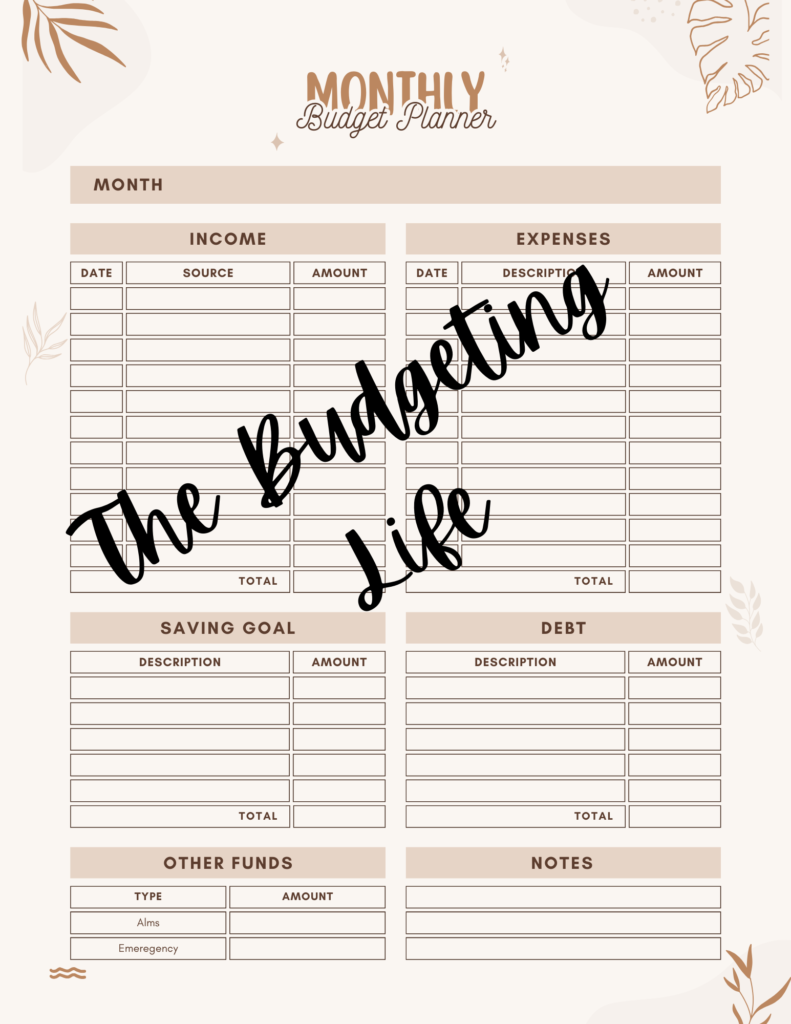

Track your spending/Download Our Free Monthly Budget Calendar

There are many ways to save money while studying. One way is by tracking your spending on a spreadsheet or diary, monitoring all of the expenses you have so it won’t be hard for future purchases either!

Tracking your spending is now made easy. Depending on your preferences, you can make use of your laptop or any device. You may also take note of your spending on your diary.

How to Track Your Spending

Tracking your spending is not a hard thing to do. In fact, it is very simple. The only thing you need is a diary, pen or your personal laptop if you will use spreadsheet.

Once they are ready, the next thing you should do is to list down your daily expenses. You can plan ahead if you want. By writing down your spending in advance, you can easily track down everything.

Also, you will know your limitations as you have already budgeted your money.

When tracking your spending on a diary or spreadsheet, you should always remind yourself to list down everything you have spent.

No matter how much you have purchased, it is wise to write down what you have spent. The reason behind it is that this can let you monitor if you have successfully budgeted your money or you have already purchased something that cost more than what you have budgeted.

Tracking everything you have spent may be a boring job for every student. But, if you really want to save money, then you should start tracking your spending.

Besides, this is not something that will consume too much of your time. The best time to track your expenses is after you have purchased what you need or require.

Make Some Extra Cash Online

With today’s advancement of technology, making some extra cash online is now made much easier and possible. If you think your budget is not enough and you don’t want to add up your debts, you may consider making some extra cash online. With this, you will avoid borrowing money and you can get rid of debts.

Ways to Make Some Cash Online

If you want extra income while studying, there are ways to make some cash over the internet. Some of them are:

Consider Paid Services

If you’re looking for a little extra cash on the side, there are companies that can pay. Make sure they don’t require any upfront payment and just provide reliable services like surveys or online jobs!

You might want to consider doing some research before signing up though because not all of these paid service providers offer high quality work at competitive rates.

Sell Products Online

If you have passion in selling products, you can launch your own website and offer products. Launching your own website does not mean to pay for hosting or anything that would let you reach your targeted audience.

You can try the free blogging platform like WordPress. Or, you can make a page on your Facebook account where you can feature your offered products. You may also try other social media sites.

Be a Freelance

Whether you are fond of writing or designing websites, you can now enjoy the freelance world. You can be a freelance writer or web designer.

There are several companies and websites that hire freelance. If you want to make the most of your skills, then you should not dare to miss being freelance.

This will give you the chance to make some cash while improving your skills. However, when searching for a company or website, make sure that they are reputable or reliable.

The reason behind it is that there are some websites that will just use your skills for scams. So, be careful when choosing one. If you don’t have any idea on which to consider, ask for some assistance from your friends or other people you knew.

There are other ways to make some cash online. It all depends on how you will take advantage of these opportunities.

However, when making extra cash online, never forget your studies. You still need to focus on your education while you are earning.

With this, you can make cash while acquiring the best education, which could lead you to your future.

Opt for Part Time Job After Classes

Part time jobs are a great way to make some money and save money for your expenses.

If you want the best of both worlds, take up an extra-curricular or part-time gig after school! You can work hard while giving yourself plenty of free time too enjoy what life has in store for us all – like watching TV with friends on Friday nights (or later).

The following passage discusses how saving money should not be overlooked when looking at different options regarding spending during weekends: “If possible try taking one evening per week off from studying so that each Sunday night will become yours alone”

Making the most of your free time by considering part-time jobs is never been a bad idea. This can give you many benefits in the long run and can also make you a better student. But, how you can seek for part-time jobs?

Making the Most of Your Free Time by Considering Part-Time Jobs

When you are looking for part-time jobs, there is much to consider. Some people may prefer local options or those that are online and available worldwide via the internet.

One popular choice among students would be applying at restaurants with steward positions open in their area of operations; this could include grocery stores as well!

The tone should still remain budget friendly even though it’s not one specific thing anymore – just make sure whatever job search strategy is being used doesn’t lead anyone astray when considering if they found what they need…

There are other options you may take for consideration. You can look online as there are also websites or companies who seek for part-timers. If you can opt for part-time jobs online, you schedule is much flexible, but since you need to concentrate on your studies.

You should do your obligations after classes in order for you to avoid any inconvenience. But, one of the things you should take note is the reputation and reliability of the company you’re working with.

Through this, you will be able to avoid those that will not pay your services. So, if this is your first time, consider shopping around all the time to deal with a good company.

You have to bear in mind that making money can be tough. So, if you don’t want to throw or spend money on things that will just waste it, then know how to pay importance with your money and try earning some of it. With this, you will be able to know how hard it is to make money.

Buying What You Need, Not What You Want

One of the best ways to save money is buying what you need, not what you want.

Through distinguishing your needs from your wants, you will be able to purchase items in a smart way. Unfortunately, not all know the difference between their needs and wants.

That is the reason why some end up purchasing their wants rather than their needs. So, before you shop, the first thing you should do is to find out your needs and wants.

More often than not, students tend to buy their wants instead of their needs. It is because at the first place, they don’t know the difference between them. Needs are something that you require for you to stay alive.

Some of these are foods and clothing. Other than these, transportation and shelter are also considered to be one’s needs. But, these belong to the slightly less needs.

The reason behind it is that anyone can stay alive and survive in this without shelter or transportation as long as they are eating every day.

How to Know What You Need and What You Want

The difference between wants and needs is the pleasure or entertainment that can be derived from it.

For example, if someone has books to read then they are not in urgent need of new clothing because there won’t derive much enjoyment out their readings with old clothes on; however an essential part about wanting something (anything) for yourself comes down to how severe your situation might actually become without having this particular product/service available at hand—in other words: “needs” should always come first!

There are other things that are considered as wants. One of these is to have a car. There are several means of transportation you can consider.

You can consider using your bicycle if you want to avoid gas expenses. Or, if you really want to drive your car, always ask if there are discounts for students.

Although not all can offer you discounts, but majority of gas stations may give you the chance to save money.

Once you have determined what you need or what you want, you will be able to enjoy savings because this can offer you the chance to reduce your expense from buying your wants.

So, if you don’t want to pay a huge debt, consider knowing the difference between wants and needs first.

Save Money Through Student Discounts

As a student, you should know how to take advantage of student discounts. Through this, way to save money will never be difficult as you will be able to spend less by acquiring the perks of having student discounts.

Unfortunately, not all students knew how to make the most of student discounts. That is the reason why others can’t save enough money while they are still studying. You have to keep in mind that you are not a student forever. So, as long as you’re a student, try saving money through student discounts.

How to Save Money through Student Discounts

Saving money with the use of student discounts is simple and can be done in simple ways. If you want to reap the benefits of being a student by using student discounts, then keep in mind these following:

Know Shops that Offer Student Discounts

Not all stores or shops in your local area offer student discounts. If you want to acquire discounts, you should know the shops that provide student discounts.

Whenever you are shopping around, always ask if they are offering discounts for discounts. Others don’t have the guts to utter these words because they are shy. But, you have to take note that there are reasons why student IDs were made.

They are not just for your personal identification, but also they can be useful when taking advantage of the discounts offered by some stores. If you want to save money from these discounts, you should always bring your ID for you to avail discounts.

Related: Be frugal without cramping your style

Search Online for Student Discounts

There are many websites that provide student discounts. There’s no need to search locally because with today’s technology, anyone can find a website where you’ll be able to get cheap deals or offers for students.

Before making any transactions online though make sure they’re reputable and offer real savings!

Save Money: Travel Cheaper

If you’re the type of student who often travel for study or pleasure, then I have a great tip.

Traveling can be costly but there’s always an option when it comes to how much we spend- and that is traveling with discounts!

Nowadays most airlines offer their own kind of coupons especially if they know about your status as being part -of something like Students Fly Free Weekend (or whatever) where everyone gets 10% off any purchase during this time period each year…

But even before these programs existed colleges offered extremely cheap fares online through sites such as FlightNetwork which connects students who want cheaper airfare.

Student discounts are like free money. If you want to enjoy your life as a student, don’t miss to save money through student discounts.

This will give you the best experience and can allow you to avail some of the things you needed at a cheaper rate. So, take advantage of student discounts and save more money while you are pursuing your studies. Check some money saving and investing resources below.

Resources

Budgeting App

Save Money Online