The best way to stay motivated despite budget challenges is to visually track your progress.

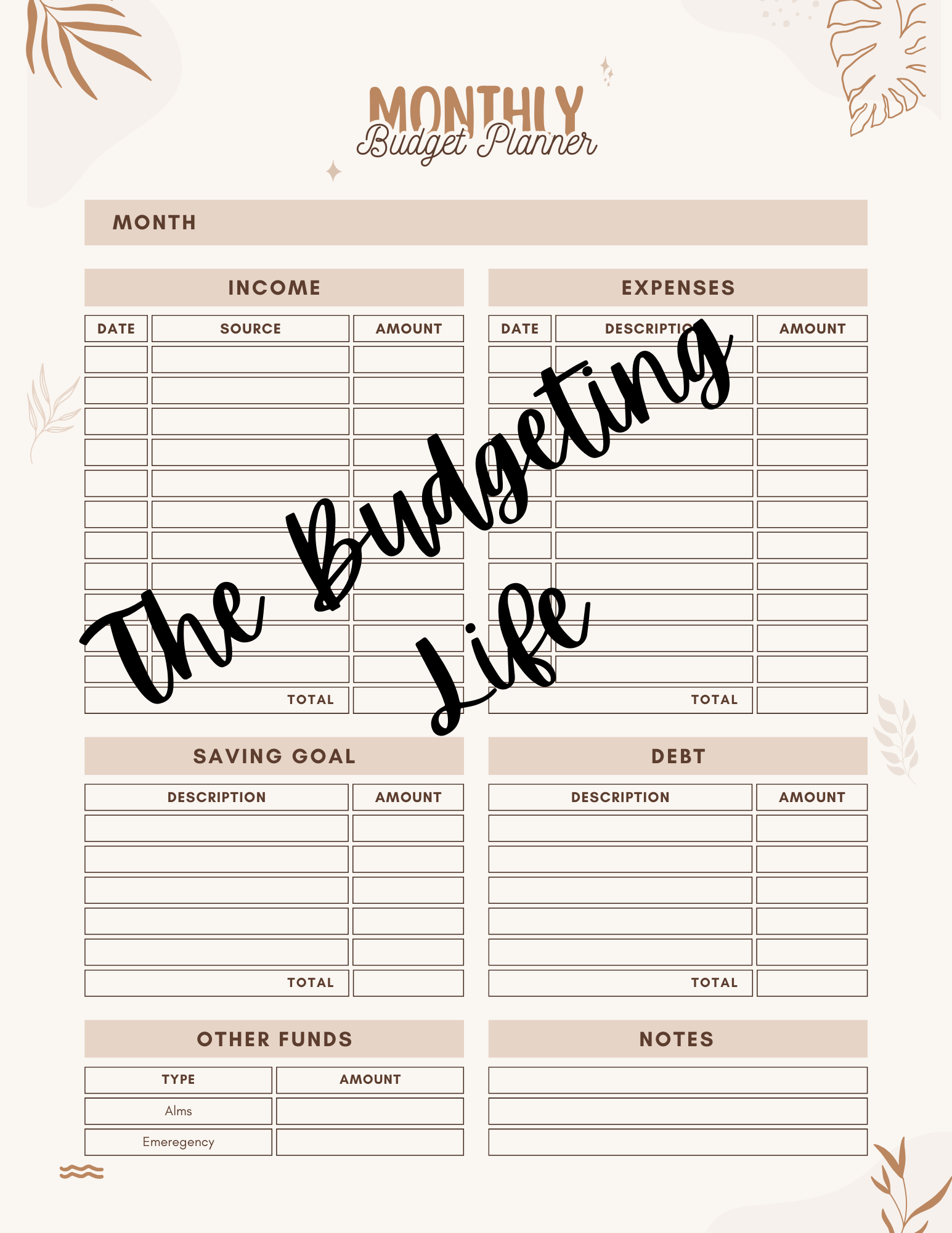

You already know from time you’ve spent on The Budgeting Life that creating and sticking to a budget is one of the biggest keys to achieving financial freedom and success.

Getting your budget just right requires a lot of preparation, honesty with yourself, and patience as you carefully track your spending.

And along the way, many challenges may arise that really test your mettle in sticking to your budget and setting yourself up right for the long-term.

Although most people recognize the importance and value of a budget, as many as two-thirds of Americans don’t have one at all.

Many others create one, but find it very difficult to stick with it and don’t know what to do when particular budget challenges arise.

It can be frustrating and even scary when such budgeting challenges present themselves, but if you’re willing to put the work in, you can face almost any hurdle and start on the road to financial success.

The Budgeting Process: Essential to Financial Success

Basically put, budgeting allows you to know exactly how much money you have coming in and where it’s going.

Most people create monthly budgets, but you can also create daily, weekly, and even yearly ones to help you stick to your financial goals.

Either way, without a budget, you will likely find yourself constantly living paycheck to paycheck, stressed out about paying your bills, and without the ability to put any money away in savings.

The quickest way to save money is to build it into your budget.

This way, you aren’t tempted to spend it, and it becomes a good money habit too. To get started, save a certain percentage of your paycheck.

Beyond helping ease your mind about paying all your day-to-day expenses, creating a budget and actually sticking to it can help you get out of debt, build savings, and learn to invest to grow your money even more.

Additionally, your budget will help you avoid spending money on things you don’t need and keep you living within your means.

But even with a good budget in place, you may still at times find yourself facing big financial and budget challenges and not knowing how to deal with them.

In this guide, we’ll take a look at a few common budget challenges and how you can effectively overcome them.

Related Article: Make Money Online Fast: Proven Ways

Common Budgeting Challenges

Perhaps one of the biggest budgeting challenges is simply making one to start with.

Many of us recognize that making a budget will allow you to take control of your finances, but if you’ve never done it before, it can seem really overwhelming.

You might be unsure of the method or software you want to use.

You might not really be motivated to track your spending by saving receipts or monitoring every transaction for a few months.

Perhaps you and your spouse disagree about certain things to include in the budget.

Maybe you simply don’t have any clear financial goals in mind, so it doesn’t feel really necessary to stick to a budget.

Simply put, though, the best thing to do is start somewhere.

You can make it easy at first, by simply making a list of your income and typical monthly expenses, like housing, food, utilities, and car insurance, and seeing what’s left over.

Perhaps you can consider automating some monthly payments so they simply come out of your bank account on time and don’t require extensive tracking or reminders to pay them.

Also remember that the same budget doesn’t work for everyone.

We don’t all have the same income and expenses, and we certainly don’t all have the same financial goals.

It’s a good idea to examine your budget on a fairly regular basis to make small adjustments here and there, and research different methods to see if a different one works better for your needs.

Keep trying until you find the right budget for you; yes, it does take some work, but it’s worth it.

Setting a clear goal can also help you stick to your new budget – maybe you want to pay off a credit card, go on a great vacation, or save for a down payment on a house.

Whatever the case, figuring out how much you need to achieve your goal can give you something concrete to work toward and help motivate you to live within your budget.

Another common budget challenge is the tendency to shop and spend impulsively.

We’ve all been guilty of it; we look at our bank account, think, “all my bills are paid and I still have quite a bit of money available to spend!” and decide to go on a shopping trip or out for a fancy meal.

We also live in a world where it’s easier than ever to spend money – not only are we constantly bombarded by advertisements and “influencers,” but with miniature computers in our pockets, it is easier than ever to tap a few buttons and make a purchase.

Budget Hack: Therefore, ideally, you want to start the budget process as late in the year as possible to maximize the number of actual months available for budgeting. But when the process is manual and time-consuming, you have no choice but to begin months in advance.

Experts say that the average American spends about $450 per month on impulse purchases, adding up to more than $5,000 per year, which is a hearty chunk of change!

There are a few things you can do to limit impulse spending. First, when you feel the urge to spend money needlessly, figure out why.

Are you feeling depressed or stressed out, or did something in particular trigger you to need a little “retail therapy”?

Also, much like when you’re following a diet, the best way to keep from spending unnecessary money is to avoid certain stores or websites that may cause particular temptation.

However, you still deserve to treat yourself once in a while, so work a reasonable allowance into your budget for “fun” purchases as well.

Along with impulsive shopping, many people spend way too much money on eating out. The average American spends at least $3,000 per year on dining out.

Think about how that adds up: if you buy a $10 lunch five days a week at work, that alone adds up to $2,600.

And these days, we have easy access to delivery from almost any restaurant with a variety of apps, but while the convenience is nice, the cost of delivery fees and tips can quickly accumulate as well.

Like shopping, it’s a good idea to work an “eating out” allowance into your budget so you can treat yourself to your favorite restaurants from time to time, but for the most part try to stick to packing your lunches, meal planning, and even cooking in bulk so you can freeze and reheat more affordable meals.

Planning Ahead for Budget Challenges

There are other big money challenges that could come up, even if you are consistently sticking to, reviewing, and updating your budget. For instance, are you factoring savings into your budget?

If not, you may be making do on a paycheck-to-paycheck basis, but you won’t be setting yourself up for future success.

It’s a good idea to go ahead and put a certain percentage of every paycheck directly into savings so that you are not tempted to spend it.

You can probably even set up part of your direct deposit from work to go directly into your savings account.

This is also where those financial goals we discussed earlier come in handy; if you have a particular goal in mind, like a vacation or a house, it will be fun to watch your savings grow and you’ll stay motivated to keep contributing to it and not spending that money.

Of course, unexpected expenses can come up at any time, and they are a challenge for anyone, no matter their budget.

This is another reason why building up your savings is important; in fact, it would probably be a smart idea to set aside a portion of that savings as an emergency fund.

You never know when your car might need a repair, you might have a medical emergency, or you may be subject to losing your job.

Ideally, you should have three to six months’ worth of your necessary living expenses saved to cover any emergencies that might come up.

Saving Money

This classic savings challenge existed long before people were posting money-saving challenges on social media.

It’s simple: Decide that you’re going to save $1 a week or $2 or $5. A manageable amount is key. If you save $10 a week, for example, you’ll have an extra $520 at the end of the year.

That can seem daunting to someone just starting out on the budgeting track, though, so start small, perhaps with your first $1,000 worth of emergency savings, and grow your funds from that point.

It’s also very crucial to be careful about your use of credit cards.

They are a necessity for some things and can be handy in the case of an emergency; and many credit cards offer cash back and other rewards that may make it worth your while to use them on a regular basis.

However, be sure you pay your balance in full each month so that you don’t rack up expensive interest charges.

If paying off credit card debt is one of your financial goals, it might be worthwhile to look into transferring your balance to a no- or low-interest card so that you can make more significant payments toward the principal balance.

To keep yourself from giving into the temptation to use your credit card for further purchases, consider locking it away somewhere that’s not easily accessible on a daily basis.

Create A Budget with Organization

A variety of apps and computer programs exist that will track your spending, categorize it, help you create a budget, note progress toward your financial goals.

In different ways, these apps monitor your bank accounts, credit card transactions, and even investments and retirement planning. Some also allow you to set spending goals.

Allocate a set amount of money as an allowance for your shopping trips. This way, you don’t overspend, but you can still enjoy yourself.

Budgets are just a set of guidelines to help you manage your money.

Once you set up your system, budgeting isn’t even that much work. If yours isn’t working for you, then scrap it and start again.

But don’t be stopped before you start by challenges that you can easily overcome.

Free: Mint Budgeting App

Why are reports so important?

Because they show you accurate data to help you make sure you are reaching your financial goals.

Reports tell you where you may be overspending or under-spending so you can make changes that accommodate your business.

They also allow you to better forecast future budgets.

Overcoming Budget Challenges is Worth It

Whether you’re just starting out on your budget journey or find yourself running into some hurdles along the way, it’s important to stay patient.

Big challenges to your budget are inevitable along the way, but we assure you that working through them and overcoming them is worth it.

In the long run, you’ll be so glad that you made the effort to stick to your budget and work through any money saving challenges that may arise along the way.

Financial Literacy

Fear of facing debt Ignorance is bliss, but it’s devastating to your finances because you don’t have a financial plan in place.

The thought of sitting down and adding up just how much debt you have can be one of the most difficult budget challenges yet.

However, the only way to regain control of your financial future is to start a debt payoff plan with your budget.

Avoiding your debt will only make it worse.

One of the most common challenges of budgeting is eating out too much. The average spent on dining out in America is a whopping $3,000 per year!

That’s a huge chunk of money that could bulk up your emergency savings account for a rainy day.

Eating out seems convenient, but it “eats” up your budget fast. Let’s say you spend $10 a day, five days a week, eating out for lunch.

That’s $2,600 you could save simply by packing your lunch. Make your first goal to pack your lunch every day instead of eating out.

When it comes to eating out regularly start a no spend challenge for the week. And take a note of your progress and build on creating a new routine.

If you don’t have a clear goal in mind, it can cause you to lose focus on why you created a budget in the first place.

You’ll be shocked by how much money you can save when you cut out restaurants.

Plus, you can pair this challenge with another easy one like the $1 bill challenge and save even more.

The Penny Challenge

This challenge is a lot like the spare change challenge.

The only difference is that you are saving all of your pennies, not all of the loose change.

It’s pretty surprising to take a large jar of pennies to the bank and discover how much you have.

Put all of this money directly into savings as soon as your jar fills up.

Keep An Eye On Personal Finance

Related: 6 Reasons You Should Have an Investing Strategy

Here are a few ways to make sure you use the budget you spent time creating:

- Schedule time throughout the year to review the budget.

- Plan budgetary meetings with your accountant and/or employees Reference the budget when proposed expenses pop up.

- Keep working toward your short and long-term financial goals and you’ll be so glad that you stuck with your budget in order to achieve them.

Keep reading The Budgeting Life to help you with more ideas to make the most of your money and finding financial freedom!

Leave a Reply