Introduction: Paving Your Path to Prosperity

To build wealth is not an overnight phenomenon. It requires dedication, discipline, and a strategic approach. In this blog post, we will explore the art of wealth-building, from understanding the true essence of wealth to mastering the wealth mindset and implementing practical strategies for financial success.

Defining Wealth: Beyond Dollar Signs

Wealth is often mistakenly equated with the accumulation of money and possessions. However, true wealth encompasses more than just material wealth.

It includes factors such as health, relationships, personal fulfillment, and a sense of purpose. Understanding this multifaceted nature of wealth is crucial to embarking on the journey to prosperity.

The Mind Matters: Mastering the Wealth Mindset

One of the key pillars to build wealth is cultivating a mindset for success. The way we think about money and wealth plays a significant role in our ability to create and sustain wealth.

By adopting a positive and growth-oriented mindset, we can overcome limiting beliefs and develop the mental resilience needed to navigate the ups and downs of the wealth-building journey.

Goal-Setting: Your Treasure Map to Success

Setting clear financial goals is like creating a treasure map that guides us towards our desired destination.

By defining our objectives and breaking them down into actionable steps, we can stay focused and motivated on our path to wealth.

However, it’s important to strike a balance between short-term desires and long-term objectives to ensure sustainable ways to build wealth.

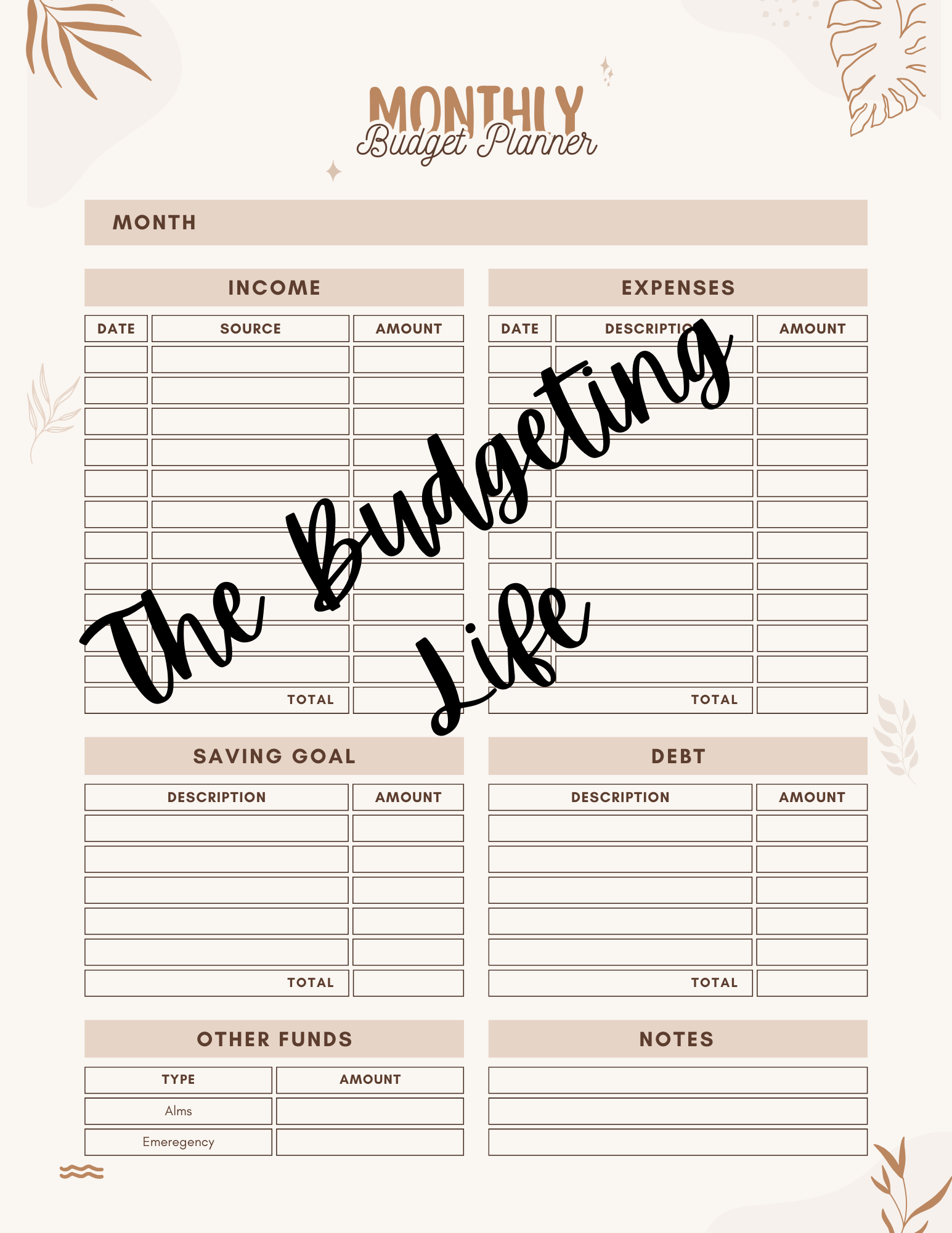

Crafting Your Financial Plan: The Wealth Blueprint

A comprehensive financial plan serves as the blueprint for wealth-building.

It involves assessing your current financial situation, identifying areas for improvement, and outlining specific strategies to achieve your goals.

By taking a step-by-step approach and regularly reviewing and adjusting your plan, you can effectively navigate the complexities of wealth-building.

Saving: The Bedrock of Wealth

Saving is the cornerstone of financial growth.

It provides the foundation upon which wealth is built.

By adopting clever saving strategies such as automating savings, cutting unnecessary expenses, and investing in high-yield savings accounts, you can secure a prosperous future.

Investing: Growing Your Money Like a Pro

Investing is the art and science of growing your money.

It involves understanding different investment options, assessing risk tolerance, and diversifying your portfolio.

By harnessing the power of compounding and staying informed about market trends, you can make informed investment decisions that accelerate your wealth-building journey.

Diverse Income Streams: More Money, Less Problems

Relying solely on a single income source can be risky.

Diversifying your income streams not only provides financial security but also opens up opportunities for exponential wealth growth.

Exploring innovative ways to boost your earnings, such as starting a side hustle or investing in passive income streams, can significantly enhance your wealth-building potential.

Entrepreneurship and Side Hustles: Your Golden Tickets

Entrepreneurship and side hustles offer a gateway to financial freedom.

By starting your own business or pursuing a profitable side venture, you can create additional income streams and take control of your financial destiny.

However, it’s important to approach entrepreneurship and side hustles with careful planning and a realistic understanding of the challenges involved.

Managing Debt: The Roadblock to Wealth

Debt can be a major roadblock to wealth-building if not managed wisely.

By demystifying the debt dilemma and adopting smart debt management strategies such as prioritizing high-interest debt and consolidating loans, you can free up resources to accelerate your wealth-building efforts.

Wealth Multipliers: Assets that Accelerate Prosperity

Wealth multiplication involves leveraging assets that appreciate in value over time.

Real estate, stocks, and other investment vehicles can serve as wealth accelerators.

By understanding the principles of asset appreciation and diversifying your investment portfolio, you can maximize your wealth-building potential.

Wealth Insurance: Safeguarding Your Fortunes

Preserving and protecting your wealth is crucial for long-term financial success.

Insurance and estate planning play vital roles in safeguarding your fortunes and ensuring the smooth transfer of wealth to future generations.

By consulting with financial advisors and regularly reviewing your insurance and estate plans, you can secure the longevity of your wealth.

Life Stages and Build Wealth: Strategies for Every Age

Wealth-building strategies vary depending on your life stage.

Tailoring your financial plan to match your current phase of life is essential for optimal results.

Whether you’re just starting out in your career, raising a family, or approaching retirement, adapting your wealth-building approach to align with your goals and priorities is key.

Legacy Building: Beyond Your Lifetime

Building a lasting legacy involves more than just accumulating wealth.

It’s about making a positive impact and leaving a meaningful mark on the world.

By incorporating philanthropy and charitable giving into your wealth-building journey, you can create a lasting legacy that extends beyond your lifetime.

Financial Literacy: The Wealth GPS

Financial education is a lifelong journey.

Continuously improving your financial literacy is essential for making informed decisions and staying ahead in an ever-changing economic landscape.

By exploring resources, attending workshops, and seeking guidance from financial experts, you can enhance your financial IQ and navigate the complexities of wealth-building with confidence.

Economic Adaptability: Navigating Financial Storms

Economic shifts and financial storms are inevitable. Building resilience and adaptability is crucial for weathering these storms and staying on track towards your wealth-building goals.

By diversifying your investments, staying informed about market trends, and maintaining an emergency fund, you can navigate turbulent economic waters with confidence.

Conclusion: Your Journey to Prosperity

Embarking on the journey to wealth-building is an exciting and rewarding endeavor.

Embark on the journey to build wealth by unraveling the multifaceted nature of prosperity. Develop a wealth mindset, establish clear goals, create a comprehensive financial plan, and navigate economic storms. Through these strategic steps, you can actively build wealth, paving your path to lasting financial success.

Leave a Reply