Budgeting 101: Your Roadmap to Financial Success

Posted in :

Budget regularly… It’s a great way to save more money, (We’ve heard that before) but it can be hard for beginners. This post “Budgeting 101 For Beginners” will teach you the basics of budgeting so that you don’t have to worry about overspending again!

Each day we make decisions based on what we want and need. Some of these decisions are easy while others can be harder choices because they require sacrifices.

Budgeting 101

The first step for beginners is all about making a plan and sticking to it no matter how tempting other purchases may seem. If you’re looking for a new resource to help guide your spending this year, then this blog post is for you!

People often hinder their own success because they think the way it cannot happen. They stop themselves before anything can be accomplished and that negativity becomes self-fulfilling prophecy, making everything impossible for yourself later on down the line.

Many people’s mindsets get in the way of achieving financial stability; but there are ways around this obstacle if you really want succeed!

Achieving financial success is not as difficult or impossible to do. It just comes with effort and knowing what you want in life, but the first step of achieving this goal and save money starts off by creating a monthly budget with your monthly income- which will help streamline all your money decisions going forward!

The following article will go over the basics of creating a budget for beginners. You will find some helpful information that will help you as well as some budgeting tips. The information provided is quite useful so make sure to pay close attention.

The Basics

A budget is the foundation of any financial success you are looking for. You need to make sure that your understanding the basics, like creating one yourself or getting help from an expert if needed, will lay a strong enough base before moving on to more complex concepts such as investing money properly!

The following information will shed light on the basics for you. Keep in mind that some information will be explained in greater detail later on in this book.

Determine What Your Current Financial Situation is:

Financial situations vary from person to person, so it’s important you know where your monthly income stands. You cannot make a bad situation seem better if its really not going well for yourself in regards with money – being honest goes square here!

Realizing how bad your financial situation is may be the motivator that you need to create a budget. People often do no change their behaviors until there is a reason to do so. Determining your living expenses may be the reason that helps you change your ways. It may seem pointless to stay on top of your utility bills, car payments, medical bills, interest rates, credit card, health insurance premiums, and even those pesky student loan payments. Yikes. This can be really overwhelming to think about.

Determine What Your Financial Future Looks Like:

Financial Success

While trying to create a budget it is important to consider what your financial future will look like if you do not create a budget for yourself.

Visualize the life of your future self if you do not get on top of finances. One key question to ask is: What are my long term goals? You may be able to provide for yourself and those closest, or they could face hard times that would make it difficult in every way possible! What might happen?

These visualizations and thoughts will likely be a motivator to help you change and create a budget. It may be scary to think about it but it can become a reality so it is important to acknowledge the fact that it can become real and change your future.

Figure Out How Much Money You Want:

Financial goals are important because they help you stay on track with your budget and paying bills. You want to try setting a general number, rather than trying for an exact figure of money.

This number will serve as your gauge to let you know if you are pulling in enough finances. Picking an exact number is a sure way to drive someone crazy and set them up for failure. Having a general number is much more beneficial because it can let someone know when they pull in more than they were expecting while at the same time lets them know if they fall behind and pull in less than what was expected.

Post: How to supplement income: 31 Ways

Be Realistic:

Creating a budget is tough enough as it is, so do not make an unrealistic one. Keep your expectations reasonable and realistic with yourself- that way if you fail then at least there are some grounds for failure rather than just giving up because this will feel too difficult or impossible to follow through on anything!

Keep in mind, you may have to create different budgets as the time goes by. You will want to start with a less complicated budget that will be easier for you to follow. Once you have been able to follow this budget without setbacks it is time to move on to more complicated and strict budgets.

Before you know it you will be budgeting at ease and all of life’s benefits will be flooding into your life.

Record Your Income

As mentioned before, when making a budget one of the most important steps is figuring out what your current monthly income is. You need to figure out the exact number of all income that you have. This will include your fixed expenses as well.

This can sometimes be a difficult process for people, especially those who are not good with numbers or have multiple forms of income to keep track of.

If you are a person who is not sure of how to or has difficulties when trying to figure out your exact income, this chapter is meant for you. Do not feel overwhelmed!

Yes, it may be a difficult process and be quite stressful, but with proper tips and the useful information this next chapter will provide you with, financial success is right around the corner.

Continue reading to learn more about recording your income, its importance, and how you can do it.

Figure Out What You Make

If you want to create a functional budget that is beneficial for you the first thing that you have to do is figure out know much money you make on a monthly basis.

It is advised that you do this with a calculator or a number machine because there will be many numbers involved and you want the calculations to be exact. As well, using a calculator or number machine will make this process much less stressful which is good for anyone.

This is especially true with a number machine because it prints out the calculations as they are made which can allow a person to make notes or easily review the information.

You need to factor in all forms of income and fixed expenses, no matter how small they may be. A lot of people make the mistake of short changing their selves while doing this step because they may think that certain forms of income are too small to count.

All forms of income must be counted; cutting yourself short can completely mess up your budget. All the small things add up so make sure to count them!

The following steps will help you to figure out what your exactly monthly income is:

Calculate The Amount In Your Liquid Accounts:

A liquid account is a general term and can include many different types of accounts. It basically refers to any type of account that you can draw money from on a moments notice. The account may include your savings account, your checking account, as well as your investment account.

While checking how much is in each one of these accounts it is important for you to remember that some of these accounts build interest and that some may have expenses attached to them.

This must also be factored in to your numbers as it will make a big difference while making your budget, even if it does not seem like it now.

Figure Out Your Exact Monthly Income:

The next thing you need to do is figure out what your exact monthly income is. As mentioned before, this can be more difficult for some compared to others for many different reasons.

Maybe they have more than one form of income or maybe they get confused by math, either way it can be quite complicated for them. Keep in mind, this is not usually an easy process for any person but it can and must be done.

For those who work on hourly wages you will begin by figuring out what your hourly pay is and then multiplying it by the number of hours you work each week.

For those who have varied schedules it is advised that you use the hours from the lowest week instead of the highest because it will prevent you from falling short in the future. Once you have done this you multiply that number by four because there are four weeks in a month. The number you calculate will be your total monthly income, that wasn’t that hard right?

For those who work on salary wages you will need to figure out how much you make on a monthly basis instead of yearly. This is because it is much easier to stick to and create a monthly budget rather than an annual one.

All you will have to do is take your total yearly income and divide it by twelve. The figure you come up with will be your total monthly income.

For those who work odd jobs or do not have regular work this process can be a little more difficult. What you need to do if you are one of these people is come up with an average amount of income for the past six months to a year. It is advised that you use a month that had hard times so that you allow yourself breathing room while you create your budget.

It is important to remember to factor in all other forms of extra income as well. Any amount needs to be factored in, no matter how small it may be. This is because you need to be very precise while figuring out how much money you pull in on a monthly basis. Everything from alimony to child support needs to be considered. Even something as small as cash back on credit card purchases needs to be accounted for in your list of earnings.

Make a List of Expenses and Put Them in Categories

The next step that you must take if you want to create to a beneficial budget is to make a list of all of your expenses and put them into categories. Just like when you were making your list of income, you must include all expenses no matter how small you may think they are. The small things add up after a while and before you know it they can overrule your budget.

This step may be a little bit more complicated than the previous one of listing your income. This is due to the fact that you will likely have many more forms or expenses than you will forms on income.

This will likely be a process that will take a bit of time to complete. It is important that while listing your expenses you are precise and take your time, cutting corners will almost surely lead to failure of your budget.

The following chapter will provide you with some tips and information that will make your experience with determining your expenses much less stressful and much easier.

What Are You Spending?

Now that you have determined what your exact monthly income is, it is time for you to begin figuring out what your monthly expenses are and to sort them into different categories. Sorting into different categories starting with your fixed expenses will help you with determining which expenses can be cut, we will go deeper in detail with this step in the post following this one.

No matter how difficult the process may be or how frustrated you get while doing it, it is important that you do this step. You must make sure that you are not spending more money on a monthly basis than you are bringing in. While making your list of expenses you will likely be shocked by the final number that you come up with. It is most likely much higher than it needs to be.

The following steps will serve as your guide through this process and make things much easier on you:

Figure Out What You Owe Each Month in Debt:

You need to determine what you spend each month on debts. This can include items such as car loans, child care, credit card, student loan payments, health insurance, and any other form of debt that you may have.

This is extremely important to do if you want to get yourself out of a hole and better your financial situation. It is important to list down each item as well as total them all together.

Remember To Include Monthly Insurance Payments:

It is important to make sure that your things are protected in life but at the same time it also important to make sure that you have the money to pay for this protection.

When you create your list of expenses you need to make sure to include all of your monthly insurance expenses. If you pay for your insurance quarterly or annually you need to divide the amount of your payment by the appropriate number so you can determine its monthly cost. Common forms of insurance people have is car insurance and home owners insurance.

Calculate Your Monthly Utility Bills:

Utilities

Utility bills must also be accounted for in your list of expenses. You cannot really figure out an exact number while doing this because your utility bills will be slightly different from month to month, especially during season changes.

You need to figure out how much all of your utility bills were for the past three months and then calculate the average bill amount for those three months. Examples of utility bills are electricity, gas, and phone bills.

Figure Out What You Spend Each Month on Groceries:

Grocery Budgeting 101

We all need to eat so we all have grocery bills. As well, we all know how expensive groceries can be. Even generic brand items seem like they are getting more and more expensive every day. It is extremely important while listing your expenses that you remember to include your average monthly expenses on groceries.

Just like with utilities, your monthly grocery expenses will likely differ so you cannot get an exact number but you can

get an average. You may find that you need to switch to cheaper brands or lay off of some items for a while.

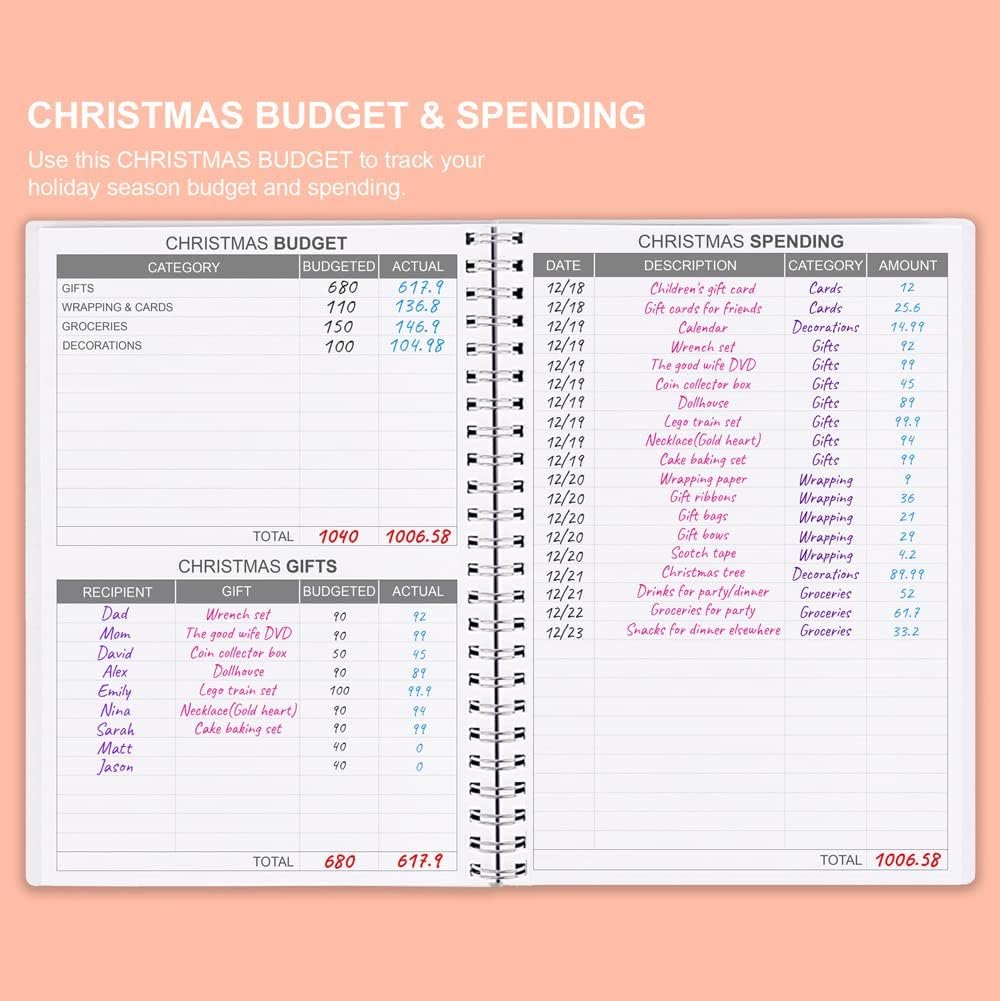

Remember Special Occasions:

While listing down all of your expenses it is important that you remember to factor in special occasions.

Events such as birthdays or certain holidays can end up being quite expensive. When you make purchases for these occasions it is important that you keep the receipts so that it is easier for you to include these expenses in your list.

Study Your Previous Cash Withdrawals:

You need to make sure that you include all of your cash withdrawals that went to various different things. You need to look at your bank statement and figure out the amount of your withdrawals and then list them down along with the reason the money was spent.

Once you have made this list it is time to move on to the next step in your journey. Continue reading to learn more valuable information.

Total Everything and Make Adjustments to Spending

While making your list of monthly expenses you likely made some very shocking discoveries. Were you spending more money each month than you thought? Do not worry if you were because this is quite common.

Not that you have come to this realization it is time for you to begin thinking about if certain changes need to take place. It can be quite easy to feel the need for expensive things that really are not necessary, but you have to ask yourself if you really need them.

The following chapter will go over the importance of getting rid of some of the financial burdens in your life and cutting down others. It will also provide you with some valuable tips that will help you to get rid of the things you do not need.

Get Rid of Unnecessary Expenses

It seems like in today’s society you have to spend money on unnecessary things in order to be able to fit in. For example, everywhere you look you will be sure to see a teenager with an iPhone or some other smart phone.

The kids that do not have one are considered to be outsiders and are not accepted by their peers. Although it may seem like a necessary expense to go get an iPhone, it really isn’t.

Now that you have made your list of your monthly expenses and your monthly income it is time to start comparing the two lists with one another. If you ever plan on getting ahead in life you must make sure that you are pulling in more money than you are spending, it’s only common sense.

This doesn’t mean that you make two dollars more a month than your expenses total up to. It means that you should have substantial breathing room because unexpected things happen in life and you may make less money during one month than others.

If you are spending more money each month than you take in you are in a bad spot and your surely know it and can feel the consequences. It can feel like you are stuck in a black hole with no way out.

The power of the hole continues to suck you deeper and deeper in until you can no longer see light and can no longer manage your debts.

If you want to adhere to a budget and create a financial success for your life you will likely have to give up certain activities and go without certain things in life for a while.

Ask almost anyone who has achieved financial success and was not just born into a rich family, they will surely tell you that they had to make many sacrifices. You have to determine what is essential in your life and what are just mere desires. Knowing the difference

between the two is extremely important as it will help you to make difficult decisions about your finances in the future. No matter how big the temptation or urge may be it is important not to spend compulsively and to adhere to your budget. After all, it was designed and created by you for you.

The following are some examples of the things you may not want to go without but need to for financial reasons for a while:

Cable TV:

The price for cable TV can really add up. How much do I watch? Is there another way to get the same programming without having this extra expense in my life

I like watching Netflix instead, but what about you guys? Have any of your friends ever told you that their bill was too high after they cancelled their service because it’s all online now or something similar, then maybe we should take into account whether saving some money on our bill would better suit us before spending more cash upfront by canceling services altogether!

Going Out:

You may need to limit going out for a while or at least restrict where you go and the amount of money that goes with. It’s advised that when trying, stay away from high priced places as these are set up in hopes of failure so your best bet is sticking close by home base until things calm down financially again

It’s hard enough spending all day on-the-go but if we can cut those costs by finding cheaper restaurants near work then it will make life easier!

Going to clubs and high priced restaurants will get you nothing but an empty wallet and over-priced food that is often times over rated. Stick to places that are a bit cheaper. Try going bowling or going out to a pool hall to play a couple games.

No matter what your interest are you should be able to find something cheaper to do that will entertain you and keep you inside of the lines of your budget.

Eat At Home More:

Eating out all the time can be really expensive. For example, I’ve been eating at fancy restaurants for only one meal every few days and it’s costing me over $100 a week! You could make that same thing in your own kitchen using recipes from cooking shows or even ones on YouTube.

Eating Out A Lot Costs More Than You Suppose

Even if you are not great at cooking you can learn. The same meal you can get from a restaurant can be prepared at home for a fraction of the price.

This is beneficial for your health as well as your budget. One thing to keep in mind as well is that your health is extremely important for achieving any type of success, including financial success so eat healthy!

Cancel Unnecessary Subscriptions:

A lot of people sign up for a magazine subscription or newspaper subscription with every intention of looking at them and reading them everyday. For some people this ends up being the case but for a lot of people it ends up being the exact opposite.

The magazines just sit around and collect dust or some people may still have newspapers from last year around their house. When you think about it, wasting money on something that does nothing more than sit around and collect dust seems kind of foolish.

The money being spent on those subscriptions could go to other valuable things. Even if you do read the magazine, do you really need it? Magazines and newspapers are just a couple examples of the countless subscriptions that a person can have.

Cancel Unnecessary Memberships:

It’s important to keep an eye on the value you’re getting from your membership. Determine if certain memberships might be unnecessary and/or too expensive for what they offer before committing!

For example, if you pay for a membership to a grocery store like Sam’s Club or Costco but have not been there in quite a while, it is probably a good idea to cancel those memberships. Another example may be if you are in some other type of club like a car club. You may have to make the sacrifice of leaving the club and suspending your membership until you can better afford the membership fees.

These are just a few examples of the things that you may have to slow down on or cut out completely to be able to stick to your budget and achieve financial success.

Conclusion:

The process of budgeting may seem like a chore, but it will be worth your while in the long run. It is important not only to stick with what you have and cut out all extras from life – “all work and no play makes Jack an dull boy” as they say-but also find ways for joys around those things we must save money on such as shopping at thrift stores or cooking meals rather than ordering takeout every night!

The idea behind creating budgets has been proven time after again: more spending power equates less stress because there’s always something left over each month which can go toward covering unexpected expenses without disrupting ones daily routines too much.

This is entirely true and working without rewards can eventually completely destroy a person’s motivation to do something. This will likely lead to you abandoning your budget entirely.

I’m sure you are already aware of the power and importance that money can have in our lives. It is not something to be taken lightly or wasted, which many people do without even realizing it!

This blog post has been a great reminder for me personally about how important budgeting your finances really is. Keep this in mind as we move forward through life together, so that all of your hard work up until now will not go to waste.

You deserve the best because you never know what could happen tomorrow! To help keep on track with your financial goals and saving more money, check out my other posts on ‘The Budgeting Life’.