Student Budgeting 101: Tips for Effective Money Management

Posted in :

We understand the importance of successful student budgeting and the challenges that come with it. It is essential to have a solid understanding of your financial situation, goals, and needs.

With careful planning, you can create a budget that will help you achieve your goals and maintain financial stability.

In this article: Student Budgeting 101, we will provide you with practical tips to create a successful budget that works for you. We will cover topics such as understanding your income and expenses, setting financial goals, creating a budget plan, and tracking your progress.

Income

Understanding Your Income and Expenses

Before you can create a budget, you need to understand your current financial situation. This means taking a close look at your income and expenses.

Start by creating a list of all your sources of income, including your salary, investments, and any other sources of income you may have.

Next, create a list of all your expenses, including your monthly bills, such as rent/mortgage payments, utilities, transportation costs, groceries, and any other expenses you have.

Be sure to include both fixed expenses, which stay the same each month, and variable expenses, which may fluctuate.

Setting Financial Goals

Once you have a clear understanding of your current financial situation, it’s time to set financial goals. What do you want to achieve with your money?

Do you want to pay off debt, save for a down payment on a home, or invest in your retirement?

Related: 6 Reasons You Should Have an Investing Strategy

Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals will help you create a plan to achieve your financial objectives.

Determine how much money you need to save, and set a deadline for achieving your goals.

Creating a Student Budgeting Plan

Now that you have a clear understanding of your financial situation and have set financial goals, it’s time to create a budget plan.

Start by allocating your income to cover your essential expenses, such as rent/mortgage payments, utilities, transportation costs, and groceries.

Next, allocate a portion of your income towards your financial goals, such as paying off debt or saving for a down payment on a home.

Be sure to prioritize your goals and allocate your funds accordingly.

Finally, allocate a portion of your income towards discretionary spending, such as entertainment and dining out.

Be sure to keep this spending in check, so you don’t overspend and compromise your financial goals.

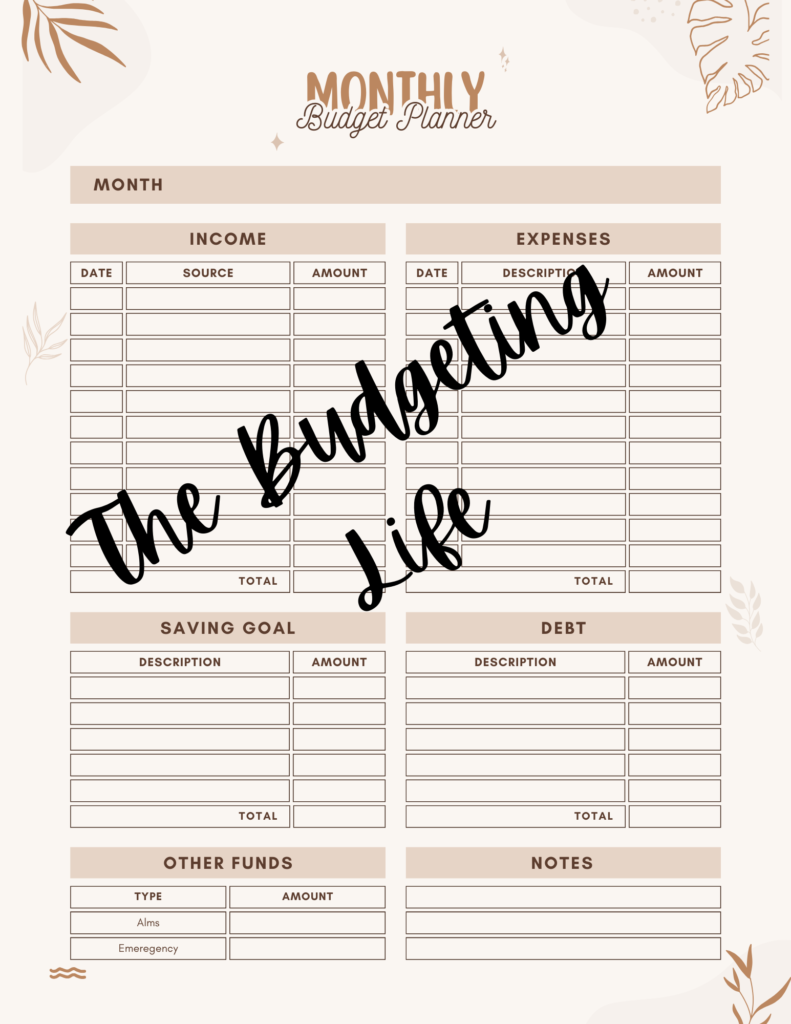

Free Budget Planner Download PDF

Tracking Your Progress

Creating a student budgeting plan is only the first step towards achieving your financial goals. To maintain financial stability and reach your objectives, you need to track your progress regularly.

This means monitoring your spending and ensuring that you are sticking to your budget plan.

You can track your progress using budgeting software, spreadsheets, or simply pen and paper. The key is to monitor your progress regularly and make adjustments as necessary.

Conclusion

Creating a successful student budgeting plan requires careful goal-setting, and tracking. By understanding your income and expenses, setting financial goals, creating a budget plan, and tracking your progress, you can achieve financial stability and achieve your financial objectives.

Remember, creating a budget is not a one-time task but an ongoing process. Regularly reviewing and adjusting your budget plan will help you stay on track and achieve financial success.

With dedication and commitment, you can create a successful budget that works for you and your financial goals.