Mastering Your Money: Top Budgeting Tips for a Stress-Free Household

Posted in :

Household budgeting tips are very important for your family’s financial well-being.

Many people don’t realize that they can save a lot of money by making simple changes to their lifestyle and spending habits.

By following just a few household budgeting tips, you can help ensure that your finances remain stable and you continue to afford necessary expenses while still having fun!

Financial management of a household can be difficult, but it’s even more challenging when you factor in the entire year.

Many people only think about their monthly expenses and don’t keep track of any other money coming into or going out for that matter- which leaves them susceptible to overspending without knowing how much they’re spending!

Helpful Budgeting Tips

The following are some of the areas that are not conventionally addressed but should be done in the quest to have a complete household budget:

You need to make sure that your finances are in order before making any big decisions. Make a clear and accurate spreadsheet on what you’re earning, as there may be multiple sources of income coming into play for your family!

There would also be a need to list the mandatory payments that are done within monthly commitments. If there is any kind of payment made in non-monthly fashion, these have to average out and include with regular household budget for the financial year.

It’s important when making an expense report on your time at work or how much money you spend each week over what period–you want it all organized neatly so anyone reading can understand quickly who does what!

Make sure to include a discretionary spending allotment in your budget so you don’t spend too much!

This should be comfortable without being excessive. It’s also important that there is still some discipline when it comes to the household finances, no matter who makes up this category.

Savings are also to be included especially if they are in the context of being part of a commitment towards some sort of plan.

Setting aside a certain amount of money each month for any number of reasons is the best way to ensure that you have what’s necessary at all times.

This can be used in emergencies, retirement savings or other long term goals depending on how committed your individual style may be with committing these funds.

If you’re carrying any debts, it’s important that these are recorded in your household budget as well.

The additional payments towards such existing platforms will only go into effect for however long is necessary until they can be paid off and cleared from one or more sources of debt.

Sticking to a budget

For some people, the act of budgeting is an easy task. But sticking to your planned expenses can be difficult when you are feeling creative or want something that’s not on this list- which often leads many individuals into failure or faltering in some way.

Easy Ways

The following are some tips to help keep this negative possibility from happening:

A household budget is an excellent way to make sure that each person in the family understands where they stand financially.

With this document, it’s easy for everyone involved with getting paid or spending money know how much time there will be left over at month-end if certain things don’t happen – like unexpected emergencies!

The spending style of an individual can be tracked to see how they spend their money.

Sometimes it’s a surprisingly eye opening experience as people don’t usually keep track the details about their habits and are thus not aware that some purchases may seem frivolous or not necessary at all.

In order for someone with knowledge on where different types or amounts go in regards to financial management, looking through one’s personal records might provide insight into what has been going on without needing any outside sources verifying facts such as income levels etc., which could allow them make better decisions going forward when managing finances

Thus this tracking will help bring some semblance of sanity back into the spending style of the individual and hopefully curb further unnecessary indulgences.

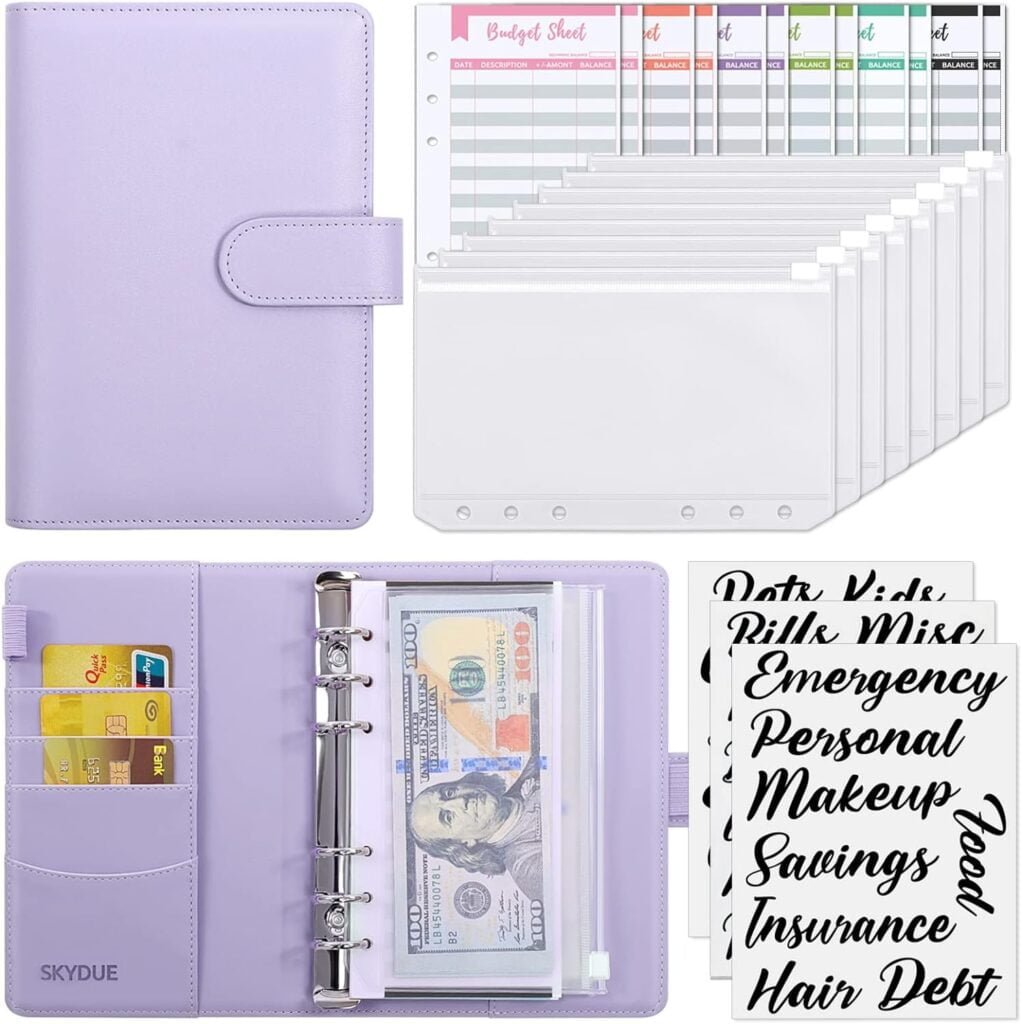

The act of using cash to make purchases is something that should be adopted immediately.

Cash exchanges are more impactful than other forms because there’s no electronic intermediate step like credit cards, which may sour your mood after an exchange if it doesn’t go well or feel inconvenient for whatever reason.

The first habit you could form would simply involve only exchanging currency in person whenever possible instead of through some sort digital mechanism such as online banking; this seems minor but I promise will make a huge impact.

One way of preventing oneself from overspending is by cutting down on window shopping sprees and other frivolous indulgences.

Window-shopping can be hard to control when one has an addiction, but it’s important that they stay strong until themselves are able do so without actually having spend money in any situation where the temptation may arise.

Related Article: 6 Ways To Travel On A Budget

Let’s Get Real! In Conclusion

There are many ways to save money, but you may have to make some changes in your life if you find it hard. The first thing is to stop spending so much time with friends who shop and spend a lot of their income on indulgences like the latest gadget, expensive restaurants, or other things that cost too much.

You might also want to limit how often you go out drinking or partying with people because alcohol can be very costly.

If these drastic measures seem necessary, try following ‘The Budgeting Life’ blog post here for more budget-saving tips and tricks.

Remember. You can do it!