Escape the Payday Loan Trap: Budget Your Way Out

Posted in :

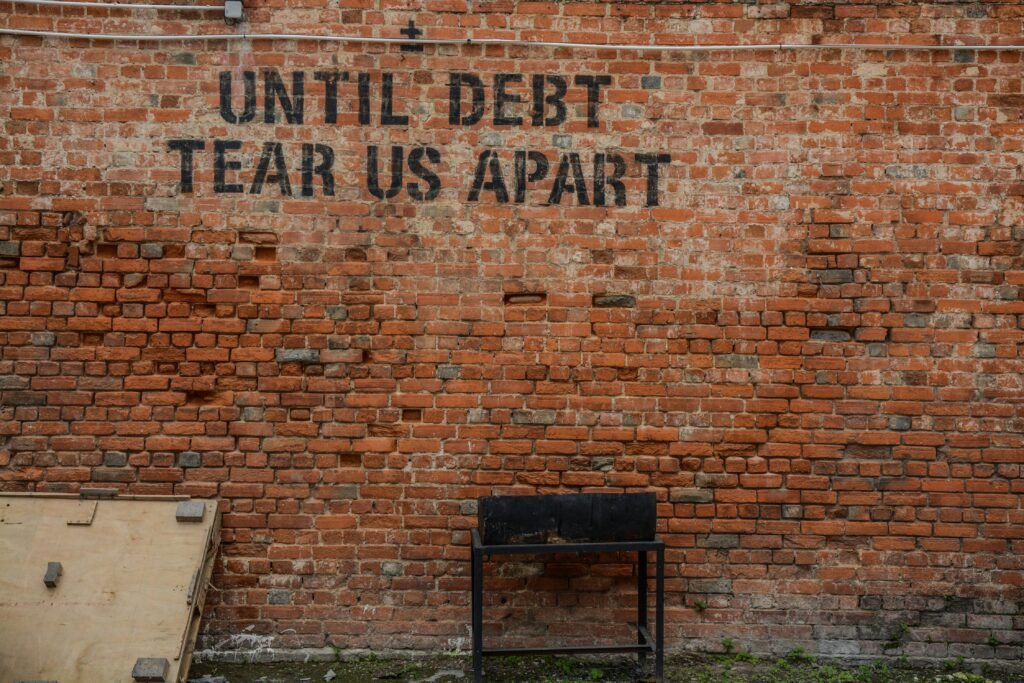

Are you tired of living paycheck to paycheck? Do you feel like you’re drowning in debt? Many people are stuck in a financial crisis, struggling to make ends meet.

To break free, you need to take control of your finances. Start by creating a budget that helps you, not hinders you. By prioritizing your expenses and making smart choices, you can escape the payday loan trap and build a stable future.

This article will show you how to budget your way out of financial trouble. You’ll get practical tips and strategies to take back control of your finances.

Key Takeaways

- Understand the dangers of the payday loan cycle

- Learn how to create a budget that works for you

- Discover strategies for managing debt and building savings

- Find out how to prioritize your expenses effectively

- Take the first step towards a more stable financial future

The Payday Loan Trap: Why It’s So Hard to Escape

Many people get stuck in the payday loan cycle, finding it hard to get out. This cycle is a big problem, making it tough to pay off debts.

The cycle starts with a loan that has high interest rates and bad terms. If you can’t pay back the loan on time, you might get to roll it over or renew it.

The Vicious Cycle of Rollovers and Renewals

Rollovers and renewals can trap you in debt forever. Each time, you pay more fees, making it harder to clear the original debt.

For example, borrowing $500 at 390% APR can cost you $645 in fees alone in a year. This is even after you’ve paid back the $500.

Shocking Interest Rates and Hidden Fees

Payday lenders charge very high interest rates and fees. These costs can be so high, it’s hard to pay off the loan.

| Loan Amount | Interest Rate | Total Repayment |

|---|---|---|

| $500 | 390% APR | $1,145 |

| $1,000 | 400% APR | $2,400 |

How Predatory Lenders Target Vulnerable Consumers

Predatory lenders target people who are vulnerable. This includes those with bad credit, low income, and communities of color. They use strong marketing and tricky loan terms to trap borrowers.

Some lenders promise “guaranteed approval” or “no credit check” loans. These seem appealing to those in urgent need of money but lead to debt traps.

Knowing these tactics can help you avoid predatory lenders. Always check the fine print and be wary of lenders that seem too good (or bad) to be true.

Taking Stock: Assess Your Financial Reality

Understanding your financial reality is key to tackling debt. First, you need to know your debts, income, and expenses clearly.

Creating Your Complete Debt Inventory

Start by making a list of all your debts. This includes payday loans, credit card balances, and high-interest loans. Note the balance, interest rate, and minimum payment for each. This list will help you see how much debt you have and where to start paying it off.

Tracking Every Dollar: Income vs. Expenses

Then, track every dollar you earn and spend. See how your income compares to your expenses to find ways to save. Use a budgeting app or a simple spreadsheet to help you.

Identifying Financial Leaks and Opportunities

After understanding your income and expenses, find where money is wasted. Look for ways to cut non-essential spending. Use that saved money to pay off your debt.

By following these steps, you’ll be able to manage your finances better. You’ll reduce your need for high-interest loans and break the debt cycle.

Your Emergency Budget Blueprint

An emergency budget blueprint is key for dealing with financial troubles and getting emergency cash when you need it. It acts as a guide, helping you manage your money well and make smart choices.

Slashing Non-Essential Expenses

The first step is to find and cut non-essential costs. Look at your monthly spending and figure out what you really need versus what you want. Cutting back on dining out, unused subscriptions, and other extras can free up money for emergency cash.

Try the “50/30/20 rule” as a starting point: 50% for needs, 30% for wants, and 20% for savings and debt. Adjusting this can help you focus on saving for emergencies.

Quick-Win Income Boosters

Boosting your income can also help save for emergencies. Look for quick ways to earn more, like a part-time job, selling unwanted items, or freelancing. These income boosters can add to your emergency fund without needing short-term loans.

Essential Budgeting Tools

Using the right budgeting tools makes managing your money easier. Apps like “You Need a Budget” (YNAB) help track spending, plan budgets, and save for emergencies. These essential budgeting tools help you control your finances and avoid short-term loans.

By using this emergency budget plan, you can build a strong financial safety net. It protects you from unexpected expenses and reduces your need for short-term loans.

Dealing with Lenders: Know Your Options

When you’re stuck in a payday loan trap, knowing your options can change everything. Financial struggles can feel overwhelming. But, being informed is the first step to take back control.

Your Legal Rights Under Federal Regulations

Under federal law, you’re protected from unfair lending practices. The Consumer Financial Protection Bureau (CFPB) watches over payday lenders. They make sure these lenders follow the law and treat you fairly.

You have the right to ask for details about your loan. This includes the total cost and how you’ll pay it back.

How to Request Extended Payment Plans

If you’re having trouble paying back your loan on time, you can ask for an extended payment plan. Just call your lender to set up a new payment schedule. It’s key to ask before the original due date to avoid extra fees.

Negotiating Settlements and Payoffs

In some cases, you might be able to settle or pay off your loan early. This means offering a lump sum that’s less than what you owe. But, be careful and know how it might affect your credit score and taxes.

Knowing your options when dealing with lenders is vital during tough financial times. By understanding your rights and how to negotiate, you can start to break free from the payday loan trap.

Better Alternatives to Payday Loans

You don’t have to be stuck in the payday loan cycle. There are better, more affordable options out there. When you face financial emergencies, look for alternatives that don’t trap you in debt.

There are many alternatives to payday loans. These include community programs, credit union loans, personal loans, and cash advance apps. They offer relief without the high interest rates of payday loans.

Community Financial Assistance Programs

Many communities have financial assistance programs for those in need. These programs might offer emergency funds, help with utility bills, or other support. Reaching out to local non-profits or community centers is a good first step to find these resources.

Credit Union Payday Alternative Loans (PALs)

Credit unions offer a better option than payday loans with Payday Alternative Loans (PALs). These loans have more reasonable interest rates and terms. They are a good choice for quick cash needs. You’ll need to be a credit union member to qualify.

Personal Loans with Manageable Terms

Personal loans from banks or online lenders can be more manageable than payday loans. They often have lower interest rates and longer repayment periods. It’s important to compare rates from different lenders.

Emergency Cash Advance Apps Worth Trying

Cash advance apps are a convenient alternative to payday loans. They let you access a portion of your earned wages before payday. Apps like Earnin, Dave, and Brigit are popular. Make sure to check their fees and terms.

Exploring these alternatives can help you avoid predatory lending and high-interest loans. Taking the time to research and compare can save you money and secure a stable financial future.

Sustainable Budgeting Strategies That Work

To get out of debt, you need a budget that keeps your finances stable. A good budget lets you manage your money well. It helps you pay bills and reach your long-term goals.

The 50/30/20 Rule for Financial Balance

The 50/30/20 rule is easy to follow. It says to spend 50% of your income on needs like rent. Use 30% for fun stuff, and 20% for saving and paying off debt. This rule keeps your spending in check.

For instance, if you make $4,000 a month, spend $2,000 on needs, $1,200 on fun, and $800 on saving and debt. This way, you stay within your budget and work towards your goals.

Zero-Based Budgeting: Give Every Dollar a Job

Zero-based budgeting means every dollar has a purpose. It’s about making sure your income minus expenses equals zero. This way, you use every dollar wisely.

To start, track your income and expenses. Then, sort your spending into categories. Assign a budget for each. Adjust as needed to keep your budget balanced.

Cash Envelope System for Spending Control

The cash envelope system helps you control spending. It divides your money into categories like groceries and entertainment. Once the money is gone, you can’t spend more until next time.

“The cash envelope system is a simple yet effective way to stick to your budget and avoid overspending.” – Financial Expert

Let’s compare these strategies:

| Budgeting Strategy | Description | Benefits |

|---|---|---|

| 50/30/20 Rule | Allocate 50% to necessary expenses, 30% to discretionary spending, and 20% to savings and debt repayment | Promotes financial balance, prioritizes needs over wants |

| Zero-Based Budgeting | Assign every dollar a job, ensuring income minus expenses equals zero | Ensures every dollar is accounted for, reduces wasteful spending |

| Cash Envelope System | Divide expenses into categories and allocate cash for each | Controls spending, helps stick to budget |

Using these budgeting strategies can help you escape debt and build a stable financial future.

Building Your Financial Safety Net

To avoid payday loan traps, building a financial safety net is key. This safety net helps you deal with unexpected costs, financial downturns, and emergencies. It keeps you from falling into high-interest debt.

Starting With a Mini Emergency Fund ($500-$1000)

Start with a mini emergency fund of $500 to $1000. This can cover small emergencies like car repairs or medical bills. You won’t need to turn to short-term loans with high interest rates.

First, look at your monthly spending and income. Decide how much you can save each month. Even small, regular savings can grow over time.

Automatic Savings: Set It and Forget It

Automating your savings is a great way to grow your emergency fund. Set up automatic savings to move money from your checking to your savings or emergency fund regularly.

Automating your savings means you save a part of your income before spending it. This method makes saving easier and less likely to be forgotten.

High-Yield Savings Accounts Worth Considering

Think about opening a high-yield savings account for your emergency fund. These accounts have higher interest rates than regular savings accounts. They help your emergency fund grow faster.

- Ally Bank Online Savings Account

- Marcus by Goldman Sachs

- Discover Online Savings Account

Emergency Fund Calculator Tools

Use online emergency fund calculator tools to figure out how big your emergency fund should be. These tools look at your income, expenses, and debt. They suggest how much you should save.

These tools help you understand your financial needs. They guide you in planning your emergency fund.

Repairing Your Credit After Payday Loans

Fixing your credit after payday loans needs a smart plan. You’ve already broken free from the cycle. Now, focus on boosting your credit score.

Secured Credit Cards for Rebuilding

Secured credit cards are a good start. They need a deposit, which sets your limit. They’re easier to get, even with bad credit. Using them wisely shows you can handle credit well.

Credit Builder Loans and Services

Credit builder loans help too. They’re made for those wanting to improve their scores. You borrow a small amount and pay it back over time. Once repaid, you’ve not only cleared the debt but also boosted your score with regular payments.

Credit Monitoring Tools to Track Progress

Keeping an eye on your credit is key. Credit monitoring tools let you watch your score and report. Services like Credit Karma and Experian offer free monitoring. This helps spot errors and negative marks, allowing you to correct them.

Debt Consolidation Options for Multiple Loans

Dealing with many loans? Debt consolidation might help. It merges all debts into one, often with a lower rate and one payment. This eases financial stress and simplifies your life. Look for good programs or lenders with favorable terms.

| Credit Repair Tool | Description | Benefits |

|---|---|---|

| Secured Credit Cards | Requires a security deposit, which becomes your credit limit. | Easier to obtain, helps build credit with responsible use. |

| Credit Builder Loans | Borrow a small amount and make regular payments. | Improves credit score by demonstrating on-time payments. |

| Credit Monitoring Tools | Track your credit score and report. | Helps detect errors or negative marks, allows for dispute. |

| Debt Consolidation | Combines multiple debts into one loan. | Simplifies finances, potentially lowers interest rates. |

Using these methods, you can fix your credit after payday loans. This will lead you to a better financial future.

Conclusion: Your Journey to Financial Freedom

Getting out of the payday loan trap needs smart planning, budgeting, and self-control. Knowing how rollovers and renewals work, and the high interest rates, is key. This knowledge is your first step towards freedom.

You’ve learned to check your finances, make a budget, and find leaks. You’ve also found better options than payday loans, like community help and credit union loans.

Use smart budgeting, save for emergencies, and fix your credit to escape the trap. Make smart choices to avoid payday loans and achieve stability.

Begin your path to financial freedom now. Use what you’ve learned and keep going. With determination and the right help, you can beat financial hurdles and look forward to a better future.