2024 Budget Planner: A Guide To Financial Freedom This Year and Beyond

Posted in :

The year 2024 is upon us, filled with possibilities and, perhaps, some financial anxieties. Wouldn’t it be empowering to take control of your money and achieve your financial goals? A powerful tool to achieve this is a budget planner. This comprehensive guide dives deep into the world of the 2024 budget planner, exploring various types, functionalities, and strategies to maximize your financial success.

Budgeting 101: Why You Need a Budget Planner

Living paycheck to paycheck can be stressful and leave you feeling like you have no control over your finances. A budget planner is your roadmap to financial freedom. It helps you:

- Track your income and expenses: Gain a clear picture of where your money goes, identifying areas for potential savings.

- Set realistic financial goals: Whether it’s saving for a down payment on a house, a dream vacation, or simply building an emergency fund, a budget planner helps you define your goals and track progress.

- Make informed spending decisions: By allocating your income towards specific needs and goals, you can avoid impulse purchases and prioritize your financial well-being.

- Reduce financial stress: Knowing exactly where your money stands can be a huge weight off your shoulders. A budget planner empowers you to make informed financial decisions and fosters a sense of control.

Choosing the Perfect Budget Planner for You

With a plethora of budget planners available, finding the right one for you is key. Here’s a breakdown of popular options:

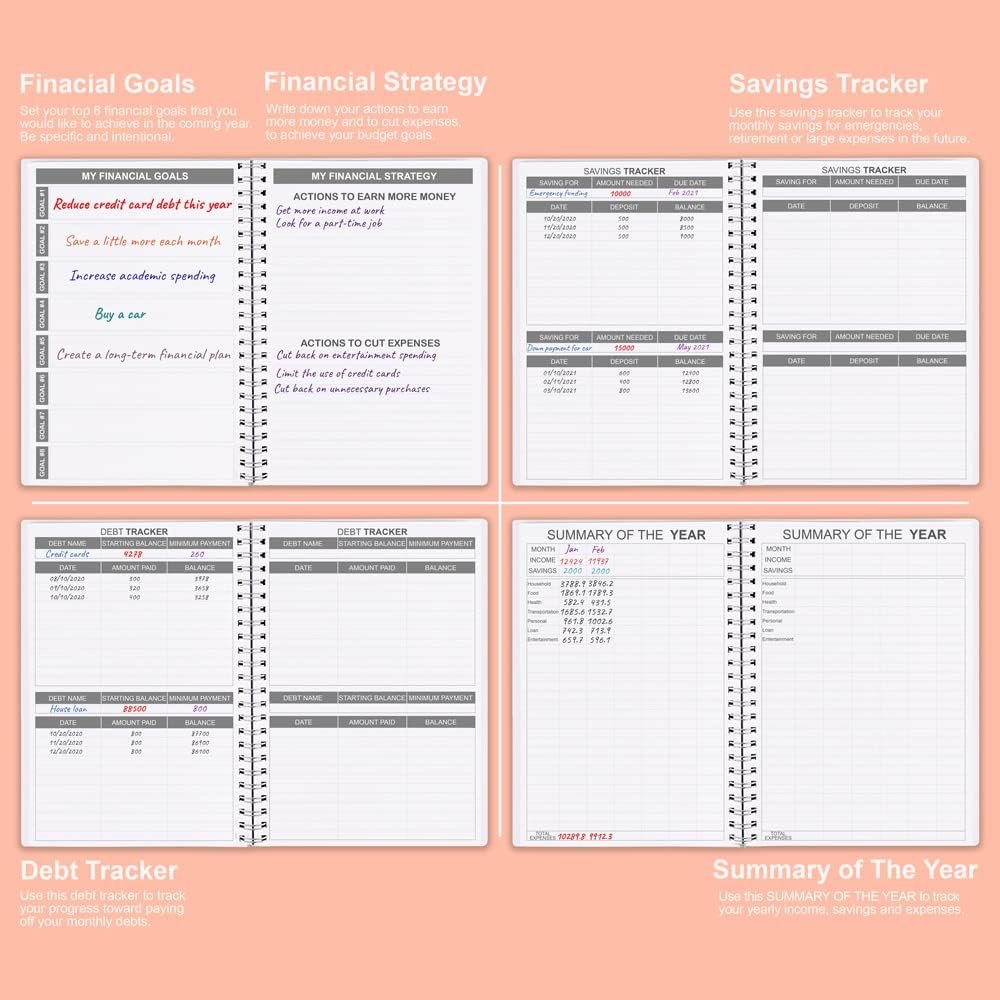

- Traditional Paper Planners: These time-tested planners offer dedicated space for tracking income, expenses, and setting goals. They are perfect for those who prefer a pen-and-paper approach and enjoy the tactile satisfaction of writing things down. Consider options with monthly bill trackers, debt repayment trackers, and savings goal sections.

- Digital Budget Planners: Embrace technology with budgeting apps or downloadable spreadsheet templates. These offer features like automatic transaction categorization, budgeting calculations, and financial goal visualizations. Look for apps that integrate with your bank accounts for seamless data import and allow for setting spending limits and reminders.

- Hybrid Planners: These combine the best of both worlds, offering space for handwritten entries and integration with budgeting apps. They provide flexibility for those who enjoy a mix of traditional and digital organization.

Beyond the Basics: Powerful Features to Look For

When selecting a budget planner, consider these additional features:

- Debt Management Tools: Track your debt balances, minimum payments, and interest rates. Look for planners with debt snowball or avalanche trackers to strategize your debt repayment journey.

- Goal Setting Functionality: Set SMART financial goals (Specific, Measurable, Achievable, Relevant, and Time-bound) and track your progress. Look for planners with space to define goals, break them down into actionable steps, and monitor your advancement.

- Bill Trackers and Reminders: Ensure you never miss a bill payment by utilizing built-in bill trackers and due date reminders.

- Sinking Funds: Allocate funds for specific upcoming expenses (e.g., holiday gifts, car maintenance) with sinking fund sections. This helps you avoid scrambling for cash when these expenses arise.

- Customization Options: Choose a planner that aligns with your financial priorities and spending habits. Look for options with customizable expense categories or the ability to create your own.

- Visualizations: Charts, graphs, and pie charts can be powerful motivators. Opt for planners that offer visual representations of your spending and progress towards goals.

Getting the Most Out of Your Budget Planner: Essential Strategies

A budget planner is a powerful tool, but it requires consistent effort to reap the benefits. Here are some strategies to maximize its effectiveness:

- Be Honest with Yourself: Accurate tracking is crucial. Track all your income and expenses, even the small stuff.

- Schedule Regular Reviews: Set aside dedicated time weekly or monthly to review your budget. Analyze your spending patterns, identify areas for improvement, and adjust your allocations if needed.

- Embrace Flexibility: Life happens. Unexpected expenses may arise. Be flexible and adjust your budget accordingly while staying committed to your overall financial goals.

- Celebrate Your Wins: Reaching milestones deserves recognition! Reward yourself for achieving savings goals or sticking to your budget for a specific period.

- Seek Support: Don’t be afraid to seek help from a financial advisor or budgeting buddy. Talking to someone about your financial journey can be motivating and provide valuable insights.

Popular Budget Planners in 2024

Here’s a glimpse into some popular budget planner options in 2024 to get you started:

- For the Traditionalist: The classic “Budget Boss” paper planner offers a comprehensive layout for income and expense tracking, with dedicated sections for debt repayment, savings goals, and bill reminders.

- For the Tech-Savvy: “YNAB” (You Need a Budget) is a popular budgeting app lauded for its user-friendly interface and helpful tutorials. It utilizes a unique method of assigning every dollar of your income a job, promoting intentional spending.

- For the Debt Slayer: “Undebt.it” is a powerful app specifically designed for debt repayment. It analyzes your debt, creates a personalized repayment plan, and provides motivational tools to help you stay on track and become debt-free faster.

- For the Couple: “Honeyfi” is a budgeting app designed for couples. It allows you to connect your bank accounts, track joint finances, and set shared financial goals.

Budgeting Beyond the Planner: Additional Tips for Financial Fitness

While a budget planner is a valuable tool, a holistic approach is essential for achieving financial wellness. Here are some additional tips:

- Automate Your Finances: Set up automatic transfers for savings and bill payments. This ensures you prioritize your financial goals and avoid late fees.

- Embrace a “Cash Only” Challenge: For a limited period, allocate a specific amount of cash for certain expense categories (e.g., groceries) and stick to it. This can foster mindful spending habits.

- Boost Your Income: Explore ways to increase your income through freelancing, a side hustle, or negotiating a raise.

- Cook More at Home: Eating out frequently can significantly impact your budget. Explore meal prepping or cooking more meals at home to save money.

- Embrace Frugal Fun: Entertainment doesn’t have to be expensive. Look for free or low-cost activities like visiting museums on free admission days, exploring local parks, or having a game night at home.

The Most Common Budget Planner Questions Answered (FAQ):

- How much should I budget for savings?

A good starting point is 10% of your income.

However, the ideal savings amount depends on your financial goals.

Are you saving for retirement, a down payment on a house, or an emergency fund? Research and set realistic savings targets based on your specific needs.

- What if I’m terrible at sticking to budgets?

Start small! Begin by tracking your expenses for a month to understand your spending habits. Then, choose a simple budgeting method and gradually adjust it as needed.

There are also many budgeting apps with helpful features and reminders to keep you on track.

- I’m overwhelmed by all the planner options. How do I choose?

Consider your financial goals, preferred budgeting style (traditional paper vs. digital), and desired features (debt trackers, bill reminders, etc.).

Read online reviews and explore free trial options offered by some budgeting apps before making a final decision.

- What if my budget doesn’t seem to work?

Don’t be discouraged! A budget is a living document, not set in stone. Regularly review your budget and adjust it as needed based on your income, expenses, and changing goals.

Popular Budget Planners

- For the Traditionalist: The classic “Budget Boss” paper planner offers a comprehensive layout for income and expense tracking, with dedicated sections for debt repayment and savings goals.

- For the Tech-Savvy: “YNAB” (You Need a Budget) is a popular budgeting app known for its user-friendly interface and helpful features. It utilizes a unique budgeting method that focuses on assigning every dollar of your income a purpose before the month begins.

- For the Visual Learner: “Mint” is a free budgeting app that excels in data visualization. It automatically categorizes transactions, creates spending charts and graphs, and provides insights into your financial habits.

- For the Debt Slayer: “Undebt.it” is a website and app specifically designed to help you conquer debt. It offers various debt repayment calculators and tools to track your progress towards becoming debt-free.

- For the Family: “Mvelopes” is a budgeting app that utilizes a virtual envelope system for expense allocation. This method is perfect for families who want to visually track spending in different categories.

Budgeting on a Budget: Free and Frugal Options

Splurging on a fancy budget planner isn’t necessary. Here are some free and frugal options to get you started:

- Free Printable Templates: Numerous websites offer free downloadable budget planner templates in various formats (PDF, Excel). You can customize these templates to fit your needs and preferences.

- Spiral Notebook & Pen: The classic approach! Grab a spiral notebook and create your own budgeting system. Track your income and expenses in a table format, and dedicate sections for goals and debt tracking.

- Budgeting Apps with Freemium Features: Many budgeting apps offer a free basic version with core functionalities like expense tracking and budgeting tools. Explore these options to find one that suits your needs without breaking the bank.

1. I’m terrible at keeping track of things. Will a budget planner help?

Absolutely! Budget planners provide structure and organization for your finances. Even if you’re not naturally detail-oriented, a planner can help you develop better habits and gain control of your spending.

2. I tried budgeting before, but I failed. What can I do differently?

Don’t be discouraged! Many people struggle with budgeting initially. The key is to find a system that works for you. Experiment with different planner styles and budgeting apps to discover what keeps you engaged.

3. How much should I allocate to savings?

A good starting point is 10% of your income. However, the ideal savings amount depends on your financial goals. Are you saving for retirement, a down payment on a house, or an emergency fund? Research and set realistic savings targets based on your specific needs and risk tolerance.

4. What if my income fluctuates?

Budgeting with an irregular income can be challenging. Track your income over several months to get an average.

Consider creating a buffer fund within your Needs category to cover shortfalls between paychecks. There are also budgeting methods specifically designed for fluctuating incomes, such as the “envelope system.”

5. Can a budget planner help me get out of debt?

Yes! Many budget planners offer debt management tools like debt trackers and progress visualizations. These can help you stay motivated on your debt repayment journey.

Consider using a budget planner specifically designed for debt elimination, like “Undebt.it,” which offers personalized repayment plans and goal setting features.

Budgeting for a Brighter Financial Future

Taking control of your finances doesn’t have to be overwhelming. With the right budget planner and a commitment to consistency, you can transform your relationship with money.

Remember, a budget planner is a tool, and like any tool, its effectiveness depends on how you use it. By incorporating the strategies outlined in this guide and utilizing the features of your chosen planner, you can achieve your financial goals and build a secure financial future.

So, take charge, embrace budgeting, and watch your financial well-being flourish!

Popular Budget Planners in 2024

- For the Traditionalist: The classic “Budget Boss” paper planner offers a comprehensive layout for income and expense tracking, with dedicated sections for debt repayment and savings goals.

- For the Tech-Savvy: “Mint” is a user-friendly budgeting app that seamlessly connects to your bank accounts, automatically categorizes transactions, and provides insightful financial reports and charts.

- For the Debt Slayer: “You Need a Budget” (YNAB) is a budgeting app with a strong focus on debt repayment. Its unique approach encourages users to prioritize allocating funds towards debts while still saving for goals.

- For the Well-Rounded Planner: The “Clever Fox Budget Planner” is a hybrid option, offering a paper planner with space for handwritten entries and integration with a companion budgeting app.

Budgeting Beyond the Planner: Additional Tips for Financial Wellness

- Embrace a Frugal Mindset: Look for ways to save on everyday expenses. Explore meal planning, utilizing coupons, and considering generic brands when appropriate.

- Boost Your Income: Explore side hustles, freelance work, or negotiate a raise at your current job. Every additional dollar adds up and helps you reach your financial goals faster.

- Automate Your Finances: Set up automatic transfers for savings and bill payments. This ensures you stay on track and avoids the risk of missed payments or late fees.

- Pay Yourself First: Treat saving like a bill. Allocate a portion of your income towards savings goals before you even begin budgeting for expenses.

- Learn to Say No: Don’t feel pressured to keep up with the Joneses. Learn to politely decline unnecessary expenses that don’t align with your financial goals.

The Most Common 2024 Budget Planner Questions Answered (FAQ)

1. I’m terrible at sticking to budgets. Will a planner help?

Absolutely! A budget planner provides a framework for accountability. Tracking your spending and reviewing it regularly can highlight areas where you can tighten your belt and identify opportunities to save.

2. Paper or digital planner? Which is better?

The best option depends on your preferences. Traditional planners offer a tactile experience and may be better for those who struggle with digital distractions.

Digital planners offer convenience, automatic calculations, and integrations with bank accounts.

3. How much should I budget for savings?

A good starting point is 10% of your income. However, the ideal savings amount depends on your specific financial goals. Are you saving for retirement, a down payment on a house, or an emergency fund? Research and set realistic savings targets based on your needs.

4. What if my income fluctuates?

A zero-based budgeting approach can be helpful for those with variable income. List all your expected income and expenses each pay period, and allocate every dollar towards specific categories until your total outflows equal your total income (zero).

5. I feel overwhelmed! Where do I even begin?

Start small. Track your expenses for a month to understand your spending habits. Choose a simple budgeting method like the 50/30/20 rule (50% Needs, 30% Wants, 20% Savings & Debt Repayment) and gradually adjust it as needed. There are also many free budgeting apps and online resources available to help you get started.

Your Gateway to Financial Freedom

Taking control of your finances doesn’t have to be daunting. A budget planner is your empowering tool to navigate your financial journey with confidence.

By incorporating the strategies and tips outlined in this guide, you can unlock a world of financial possibilities.

Remember, consistency is key. Regularly review your budget, celebrate your wins, and don’t be afraid to seek help if needed.

With dedication and a budget planner as your companion, you can achieve your financial goals and build a secure financial future.refresh Regenerate drafts volume_up

- For the Traditionalist: The classic “Budget Boss” paper planner offers a comprehensive layout for income and expense tracking, with dedicated sections for debt repayment, savings goals, and bill reminders.

- For the Tech-Savvy: “YNAB” (You Need a Budget) is a popular budgeting app lauded for its user-friendly interface and helpful tutorials. It utilizes a unique method of assigning every dollar of your income a job, promoting intentional spending.

- For the Visual Learner: “Mint” is a free budgeting app that excels in data visualization. It automatically categorizes transactions, generates insightful spending charts, and allows you to set custom financial goals with progress tracking.

- For the Debt Slayer: “Undebt.it” is a powerful app specifically designed for debt repayment. It analyzes your debt, creates a personalized repayment plan, and provides motivational tools to help you stay on track and become debt-free faster.

- For the Couple: “Honeyfi” is a budgeting app designed for couples. It allows you to connect your bank accounts, track joint finances, and set shared financial goals.

Budgeting Beyond the Planner: Additional Tips for Financial Fitness

While a budget planner is a valuable tool, a holistic approach is essential for achieving financial wellness. Here are some additional tips:

- Automate Your Finances: Set up automatic transfers for savings and bill payments. This ensures you prioritize your financial goals and avoid late fees.

- Embrace a “Cash Only” Challenge: For a limited period, allocate a specific amount of cash for certain expense categories (e.g., groceries) and stick to it. This can foster mindful spending habits.

- Boost Your Income: Explore ways to increase your income through freelancing, a side hustle, or negotiating a raise.

- Cook More at Home: Eating out frequently can significantly impact your budget. Explore meal prepping or cooking more meals at home to save money.

- Embrace Frugal Fun: Entertainment doesn’t have to be expensive. Look for free or low-cost activities like visiting museums on free admission days, exploring local parks, or having a game night at home.

The Most Common Budget Planner Questions Answered (FAQ):

- How much should I budget for savings?

A good starting point is 10% of your income. However, the ideal savings amount depends on your financial goals. Are you saving for retirement, a down payment on a house, or an emergency fund? Research and set realistic savings targets based on your specific needs.

- What if I’m terrible at sticking to budgets?

Start small! Begin by tracking your expenses for a month to understand your spending habits. Then, choose a simple budgeting method and gradually adjust it as needed. There are also many budgeting apps with helpful features and reminders to keep you on track.

- I’m overwhelmed by all the planner options. How do I choose?

Consider your financial goals, preferred budgeting style (traditional paper vs. digital), and desired features (debt trackers, bill reminders, etc.). Read online reviews and explore free trial options offered by some budgeting apps before making a final decision.

- What if my budget doesn’t seem to work?

Don’t be discouraged! A budget is a living document, not set in stone. Regularly review your budget and adjust it as needed based on your income, expenses, and changing goals.

Conclusion: Your Roadmap to Financial Freedom Starts Today

Taking control of your finances is empowering.

A budget planner is your trusty companion on this journey. By choosing the right planner, employing effective strategies, and embracing a mindful approach to spending, you can achieve your financial goals and build a secure financial future.

Remember, consistency is key. Regularly track your progress, celebrate your wins, and don’t be afraid to seek help if needed. With dedication and the right tools, you can transform your relationship with money and embark on a path towards financial freedom.